The Influence Analysis of Internet Finance on China’s Banking Industry Development

Volume 8, Issue 3, Page No 250-261, 2023

Author’s Name: Yangshichi1, Hayoung Oh2,a), HyunJong Kim3

View Affiliations

1Department of Economics, Sungkyunkwan University, Seoul, 03063, Korea

2 College of Computing & Informatics, Sungkyunkwan University, Seoul, 03063, Korea

3Department of Artificial Intelligence Convergence, Sungkyunkwan University, Seoul, 03063, Korea

a)whom correspondence should be addressed. E-mail: hyoh79@gmail.com

Adv. Sci. Technol. Eng. Syst. J. 8(3), 250-261 (2023); ![]() DOI: 10.25046/aj080328

DOI: 10.25046/aj080328

Keywords: Internet finance, electronic payment, VAR model

Export Citations

This article presented an overview of the evolution of China’s internet financial industry, emphasizing the critical importance of fintech, a novel economic sector improving the efficiency of financial services through innovative technology applications. The systems referred to encompass those technologies, applications, and tools that enhance the efficiency and accessibility of financial services. The historical trajectory of fintech, recent developments, and potential risks were thoroughly examined. A case study was conducted focusing on the significant factors influencing electronic payment in China. The study identified and analyzed key elements shaping China’s electronic payment landscape using the VAR model. The results offered insights into the future development of the electronic payment system in China.

Received: 21 January 2023, Accepted: 28 May 2023, Published Online: 25 June 2023

1. Introduction

At the turn of the 21st century, the internet finance industry developed rapidly, following more broad technological improvements of the Internet. Fintech, a brand-new economic industry composed of systems that use technology to improve the efficiency of financial services, has commanded attention in both the United States and China. According to this research [1] defined internet finance as a system that is distinguished from both indirect commercial financing and direct financing in the capital market. This research [2] maintained that internet finance is an extension of traditional financial services to the internet that enhances existing business models and internet technologies that play only supporting roles in financial activities.

This article mainly focuses on analyzing the development of the internet finance industry in China. In 2019, the People’s Bank of China published a Notice by the People’s Bank of China of Issuing the Fin Tech Development Plan (2019-2021) (AKA the “Fin Tech Development Plan”), underscoring the importance that the Chinese government placed on Fintech. Internet third-party payment options such as WeChat Pay have disrupted traditional means of payment, such as credit cards and cash. In addition, internet-based finance companies also threatened to overtake the fundamental functions of saving and loan intermediation through traditional banking.

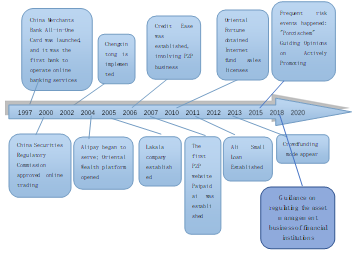

The flourishing development of internet finance has dramatically changed the banking industry in China. For instance, many banks have developed P2P online lending businesses to attract clients. Also, according to the official China Financial Stability report, published by the People’s Bank of China, China’s internet finance development has been tepid. Although there are landmark events almost every year (see Figure 1), such as the advent of Alipay in 2004 and the establishment of Alibaba Microfinance in 2011, they have not been broadly accepted by the Chinese public. Until 2013, taking the YueBao as the special mark, the scattered funds and fragmented needs of the public were starting to be met. The year 2013 marks the beginning of Internet finance in China. Not only did the new products emerge and thrive, but they reached an unprecedented level of popularity with consumer groups.

In addition, the COVID-19 situation has made people prefer to transact through contactless services, leading to increased digital experience and maturity.

Internet finance has played an active role in increasing methods of investment, improving the efficiency of capital allocation, promoting financial product innovation, advancing the process of interest rate marketization, and stimulating economic development. However, China’s Internet finance is still in the initial phase, relevant laws and regulations are lagging behind, and various risks remain. Therefore, risk control has become an important factor in China’s financial stability. For this reason, on March 5, 2014, Premier Li Keqiang noted in a government work report: “To promote the healthy development of Internet Finance, we need to enhance the financial supervision and must maintain the bottom line to prevent systemic financial risks.”

This article references the latest research about Fintech from Chinese core journals, the Wall Street Journal, Mycaijing, and related websites to analyze and summarize current Chinese research and progress from multiple aspects such as the internet financial market and specific Fintech company development analysis. It then predicts the future development tendencies of Chinese international finance markets (P2P) in the context of Fintech.[3], [4],[5] and [6]

Figure 1: Development of China’s Internet Finance Industry

Source: Liu Wei. The Beautiful Era of Internet Finance in China

The first part of this article will introduce the essential attributes of internet finance development in the banking industry from different perspectives, thus explaining multiple forms of internet finance. It provides a clear scheme describing the whole Internet finance industry while analyzing drawbacks and highlighting risks in the internet finance industry.

This article will focus on the specific influence of third-party payment on the traditional banking industry, which has been a hot issue in Chinese society. Revenue that traditional banks rely on is highly disrupted by this new technology. Since Chinese citizens have started to use electronic payment for daily expenses, even traditional banks are starting to offer this new payment system. Therefore, it is necessary to illustrate the real effects that third-party payments have on traditional banks to propose useful solutions to help them to adapt to this new payment model.

2. Recent Fintech Development

Following the increasing popularity of the Internet and development of the related science, the influence of modern informational technology, represented by Internet technology, has had an increasing impact on traditional finance. This technology [3] has prompted the growth of internet finance to accelerate and become more reliable. China’s internet finance has developed over a period of about 20 years and has spawned the electronic banking model, online financial management model, third-party payment model, and virtual currency model. These models usually have their beneficials and the models themselves depend on different basements.

2.1. E-banking Model

Electronic banking refers to electronic services that financial institutions provide to consumers and include but are not limited to telephone banking, mobile banking, and online banking. China’s online banking service [4] was first developed by China Merchants Bank in 1997. Mobile banking has emerged and become popular very fast in recent years. According to a survey conducted by iResearch, online banking accounted for 90% of the whole financial technology market trading volume. Figure 1 shows that whether measured in the proportion of corporate online banking users or the proportion of personal mobile banking users, the number of people using mobile banking has increased each year.

2.2. Online Financial Management

In online financial management [5], financial planners may independently choose different financial management methods such as financial insurance, banking services, and funds using online financial platforms. The most important aspect of online financial platforms [6] is that there are no space restrictions for online financial management, which means users may conduct their financial business anytime, anywhere. In addition, because services are available 24 hours per day, 7 days per week, online financial management has become more popular with users than offline financial management. Internet financial companies have also frequently launched online wealth management products. Yuebao, Baidu Wealth Management, and Tiantianfu are all popular online financial management platforms. Taking Yuebao as a specific example, Table 1 shows that from the end of June 2018 to the beginning of March 2021, Yuebao’s capital scale expanded from 47 billion to 73.5 billion, and the number of users increased from 68.8 million to 108 million. Such achievements indicate the appeal of online finance and also highlight the good prospects of online financial management.

Table 1: Yuebao’s capital scale and numbers of users during different periods

Source:2018-2021 Yu’ebao User Analysis Report

| Date | Fund size(100 million) | Number of users(10,000) |

|

2018 6.30 2018 9.30 2018 12.30 2020 6.30 2020 9.30 2020 12.30 2021 1.30 2021 3.30 |

4725 4980 5200 5620 6305 6950 7200 7350 |

6980 8100 8950 9250 9670 10025 10420 10800 |

2.3. Third-Party Payment Model

The whole scheme of third party payment can be illustrated using Alipay as an example [7]. After a buyer selects goods to purchase, their money is sent to an Alipay account. Then the Alipay platform informs the seller to ship the goods. Finally, the buyer confirms receipt of the goods and Alipay pays the seller. If the consumer is dissatisfied and seeks to return the goods, the third-party payment platform transfers payments back to the consumer’s account after it confirms that the seller has received the returned goods. The major domestic Chinese third-party payment platforms include Alipay, Tenpay, Epay, and Kuaiqian.

According to a survey [8] conducted by iResearch, third-party payments accounted for 94.4% of transactions in 2015, and therefore became the most widely recognized Internet financial model (iResearch). Among Internet financial products/services in China, third-party payment accounted for 95.6% of transactions, becoming the most commonly used pattern. Table 2 shows that by the end of 2020, the transaction scale of China’s third-party payment market was expected to reach 50 trillion yuan, while in 2009 it was only 3.1 trillion yuan.

Table 2: Third-party payment market transaction scale from 2009 to 2020

Source: Third-party payment in 2020 Internet Finance Year-end Report

| Table 2 Third-party payment market transaction scale from 2009 to 2020 | Table 2 Third-party payment market transaction scale from 2009 to 2020 | Table 2 Third-party payment market transaction scale from 2009 to 2020 |

| Table 2 Third-party payment market transaction scale from 2009 to 2020 | Table 2 Third-party payment market transaction scale from 2009 to 2020 | Table 2 Third-party payment market transaction scale from 2009 to 2020 |

2.4. Internet Lending Model

Online lending refers to the process of authentication [9], accounting, clearing, and delivery through online platforms for both parties. In 2007, China’s first online loan company was founded, while in 2018, there were about 1021 online loan platforms with a total transaction volume of more than 230 billion yuan. However, in 2020, there were only about 343 online loan platforms with a transaction volume of 86 billion yuan (Table 3). Here, this article will mainly focus on P2P microfinance financial platforms.

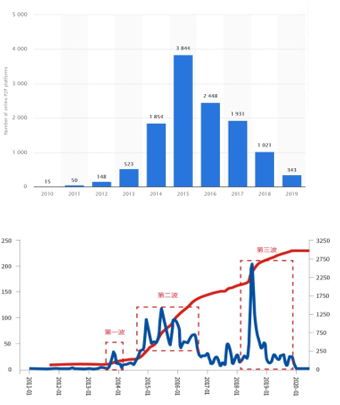

Simply speaking, the P2P financial platform [10] is a new online financial model, in which the payer lends funds to the borrower in the form of a credit loan through an intermediary agency. P2P has low entry barriers and involves mostly small loans, which allows customers to easily conduct online financial trading while diversifying loan risks. Representative domestic P2P online financial platforms include Renrendai, Yirendai, Papadai, and Helidai. The main target customers for these platforms are investors with small funding needs, such as small business owners, poor rural farmers, and college students. These groups were not well served by traditional financial institutions. The growth of P2P in China has been quite rapid. China ‘s first P2P website, Paipaidai, was launched in August 2007. In October of the same year, Yixin’s online loan platform was launched. In 2015 the number of platforms reached its peak at 3814, while as of 2019, the number of loan companies decreased to 343. This trend indicates that in recent years, the drawbacks of the p2p platform have become clear. The first is that there are no entry barriers, and the second is that there are no operating rules. Finally, there is no external supervision. For example, in October 2019, Wang Longyu, the head of the Angel Project website, lost contact without omen and directly lead to thousand millions losses. In June 2018, the Gold Rush Loan service that had been launched only 5 days prior defrauded more than 100 domestic investors. Although Table 3 shows that the transaction scale and number of companies involved in Chinese P2P loans increased from 2012 to 2015, Figure 2 shows that Internet lending platforms and China’s bad debt rate continued to increase from 2014 May to 2020. In addition, according to a survey conducted by iResearch, in 2015 the P2P platform accounted for 32.2% of Chinese Internet user’s perceptions. Among Chinese Internet financial services, the P2P platform accounted for 2.2% of transactions. Even the result has big gap between offline and online payment.

Table 3. Source: Statista Number of online peer-to-peer lending platforms in China from 2010 to 2019

Figure 2: Bad debt rate in China’s P2P platform (red: cumulative number of problem platforms; blue: month statistical quantity)

Source: WangDaiZhiJia

3. Risks of China’s Internet finance industry

There are many risks involved in China’s internet finance industry. Some of these risks may only cause limited losses in one aspect of internet finance, but others may be catastrophic. However, whether the risk is systematic or unsystematic, there are some effective strategies to prevent risk.

3.1.1. Run risk

Run risk [11] is a very uncertain factor, because emergencies shake people’s confidence in financial investment. Some internet finance platforms are connected to monetary finance, which means that when a run risk occurs in monetary finance, internet finance will be affected. Taking Yuebao as an example, once the declining amount of Yuebao’s rate of return exceeds consumer expectations, run the risk is very likely to happen. As the risk occurs, whether it is a rumor or real, it will spread through the internet very quickly. Yu’ebao can only use deferred payments to address such a situation, and this is why a run risk is inevitable. The most serious potential result is that Yuebao withdraws from the internet finance area. As risk occurs, internet financial institutions may encounter a shortage of funds for a few days or even collapse in the worst case scenario.

3.1.2. Internet technology management risks

No matter the period, science and technology are the primary productive forces. To maintain the high development speed of Internet finance, it is important to carefully decide in which technology to invest in terms of both safety and reliability. Internet finance is vulnerable to hackers, while systemic failures (both hardware and software), power failures, and computer viruses can all lead to serious losses to financial institutions. Therefore, a stable system itself is the core of internet finance [12].

At the same time, the importance of technology management is also reflected in product support. A mature or popular technology will promote positive marketing extension. Google Wallet launched in the UK in 2011 using a very advanced technology called NFC that is supported neither upstream nor downstream. Because the technology was so sophisticated, with less than 15 kinds of smartphones on the market supporting such technology, it was difficult for merchants to accept payments through NFC. Eventually, this problem led to the inability of the service to become more widespread [13].

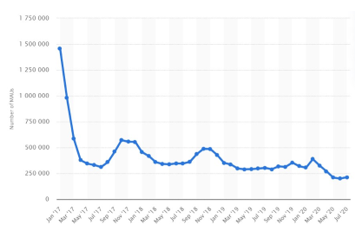

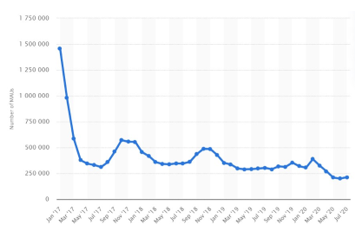

Figure 3 shows that even in recent time periods, the service did not acquire sufficient market share.

3.1.3 Institutional risk

China’s Internet finance industry is insufficiently supervised and regulated, which has led to exposure to more problems. Since there are no clear laws or regulations for this market, internet finance-related industries are free to engage in immoral operating behaviors, which provides benefits to the companies themselves while hurting consumers and the whole internet finance market. In addition, inadequate supervision in the whole market makes it difficult for law-abiding internet financial institutions to manage their companies effectively [14]. Because there are no clear boundaries between legal and illegal internet finance behaviors, internet financial institutions can easily wander among legal-blind spots, which may cause unintentional irregularities. In other words, some companies may implement behaviors that are seen as negative under unrealized situations. If unintentional irregular behaviors were defined as violations, many Internet finance institutions would suffer huge losses.

Figure 3: From January 2019 to July 2020 (United Kingdom)

Source: Statista

3.1.4 Credit risk

In terms of target consumer selection, Internet finance platforms are at a disadvantage because access to Internet financial platforms is not strict, which means users can simply register on platforms provided by internet institutions. The requirements for obtaining an Internet loan are very low, usually only a very simple identification test, after which consumers may freely conduct transactions. Even if a customer is required to fill out a basic form to collect basic information, this cannot prevent users from falsifying or concealing important information. Additionally, there is great difficulty evaluating user credit. All of these elements make it very difficult to ensure that online traders complete transactions in good faith in the absence of a credit system. Taking online lending as an example, if a borrower deliberately escapes from bearing the obligation of repayment after accepting a loan from the lender, the loss is borne by the Internet financial institution.

3.1.5 Crime risk

China’s Internet finance currently lacks laws, regulations, and regulatory systems. Moreover, most Chinese Internet finance companies lack self-discipline, causing many employees to commit crimes for personal benefit. For law-abiding institutions, the risk of crime mainly comes from surrounding cooperating companies.

Since the development of Internet finance technology, illegal fund-raising, private capital pool abuse, and money laundering have continued to occur. Furthermore, if nepotistic organizations in the same industry violate the law due to poor management, organizations suffer great losses. According to the Global Economic Crime Survey published by PricewaterhouseCoopers on March 18, 2019, Internet crime has become one of the four major economic crime categories in 2018, and has become the second most serious economic crime type affecting the financial services industry.

At the same time, data from the Ministry of Public Relations shows that in recent years, the number of Internet crime cases in China has increased at an annual rate of 30%, and the amounts of crime and hazard continue to expand. An average amount of more than several hundred thousand yuan per criminal case (with a maximum of more than 14 million yuan involved), in the internet financial sector accounted for 61% of China’s online cases. All of these cases have led to losses of nearly 100 million yuan every year.

3.2. Risks faced by users

3.2.1. Operational risks of financial institutions

The interests of Internet finance users are closely related to financial institutions. If internet financial institutions fail due to poor management or dishonest operating, users are vulnerable to losses. Dishonest operations mainly include illegal behaviors, such as managers absconding from the company, concealing risks, exaggerating returns, and providing false information. Taking P2P as an example, from the beginning of 2015 to 2019, more than 70% of P2P platforms went bankrupt (Figure 4). These events involved a total of more than 1.2 billion yuan. Among them, in October alone, 40% of P2P platforms announced that their capital chain was broken or closed. Meanwhile, due to the weak sense of self-discipline in the industry, Internet finance institutions frequently engage in dishonest operations driven by their own interests that seriously jeopardize the interests of users.

Figure 4: Decreasing number of P2P platforms

Bar: The Number of P2P platforms

Line: Increasing Rate (Year)

Source: WangDaiZhiJia

3.2.2. Information security risk

The scope of information security is separated into two main categories. The first is malicious intrusion into internet financial websites, which leads to information leakage. The second involves Internet financial institutions secretly and illegally stealing, buying, and selling the personal information of users. Regardless of whether Internet financial institutions have the right to collect personal information, if it is leaked it can lead to great losses to users. According to the 2020 China Internet Security Report, in 2020, 84.8% of China’s Internet users encountered network information security incidents, with a total of 456 million incidents such as personal data leakage and insecure online shopping or payment. Among these netizens, 77.7% suffered losses, and 7.7% of the events caused economic losses, involving direct economic losses of up to 19.4 billion yuan.

- Rights protection risk

The drawback of China’s Internet financial laws and regulations is not only reflected in the lack of clear provisions to restrict behavior, but also in the failure to protect the rights and interests of users. For instance, some Internet financial companies conceal risks deliberately, exaggerate returns, and intentionally provide false information. Furthermore, some companies even deliberately sell or uncover customers’ private information, which infringes on their right to information, right to fair deals, right to choose freely, and privacy. Among China’s Internet supervision laws, there are flaws in special regulations regarding the protection of users’ rights and interests. The current basic civil laws in China cannot provide Internet financial users with enough protection, nor can they effectively recover user losses, which are caused by illegal financial behaviors.

4. Risk Analysis: Predicting development of electronic payment in China

Risk Analysis: Predicting the Development of Electronic Payment in China

Given the complexities and dynamism inherent in internet financial data, it was essential to employ a model capable of accurately capturing and reflecting these aspects. Therefore, this article used the VAR (Vector Autoregressive) model [15] to conduct specific data analysis. The VAR model was selected for its unique capacity to handle multiple interrelated time series and its allowance for each variable to be a function of past lags of all variables in the system. Furthermore, in contrast to traditional regression models, the VAR model allowed us to directly examine the relationships between economic variables under the time series, effectively sidestepping issues of mistaken endogeneity or exogeneity [16].

Improvements were made to the traditional VAR model based on lessons drawn from previous research [17]. The article first introduces the VAR model, then proceeds to make reasonable assumptions and explain variable selection to ensure accuracy and interpretive power of the results. The stability of the data used in model building and data fitting was ensured through unit root tests. The EG-test was employed to ascertain that the residual terms in the model would not negatively impact the results, thus ensuring that the time series data were suitable for the research.

During the construction of the VAR model, selection criteria including AIC, HQ, SC, and FPE tests were applied to identify the most suitable VAR model, yielding the most reliable model. Following an impulse response analysis, a forecasting analysis was carried out – a step often omitted in previous studies. The forecasting results were then leveraged to provide valuable insights and recommendations for the future of the Chinese internet finance industry.

4.1. Introduction to the VAR model

4.1.1. Introduction to the VAR model

Traditional regression models are mostly dependent on basic economic theorems, which can help to explain the behavior of economic agents. Then, researchers can also use the model to analyze how exogenous variables affect endogenous variables. However, traditional regression models have drawbacks, such as mistakenly taking some variables as endogenous, exogenous, or predetermined. Such decisions are often subjective because variables may be highly correlated. Another drawback is that when constructing a joint cubic model, in order to make the model identifiable, certain variables must be abandoned from the original economic equation.

The VAR model can solve such problems because the core idea of the VAR model is to disregard economic theory and directly consider the relationships between economic variables under the time series.

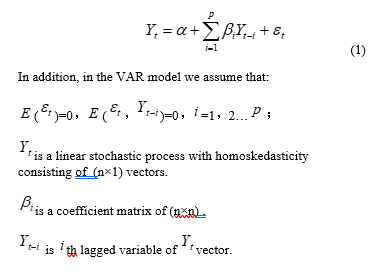

The normal general form of VAR is:

is an error term and can be considered as a random disturbance term in this model.

4.1.2. Ensure the optimal lagging parameter for the VAR model

Since the establishment of the lagging parameter for the VAR equation is strongly influenced by multiple variables, it is necessary to conduct stability tests for the target dataset. Through the Box-Jenkins test, we defined that, basing on the autocorrelation coefficient graph, if the coefficient decreases rapidly as the value of the autocorrelated lagging parameter increases, the time series is a stable series. If the conditions are not met, it is an unstable series. However, this testing method is highly dependent on subjective decisions. Therefore, Dickey and Full proposed using the DF statistic to test whether the data are a stable series, and later modified and improved it by introducing the ADF statistic to perform the test.

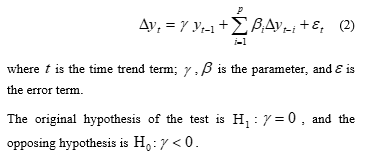

The ADF test model is as follows:

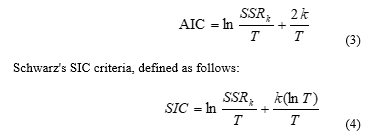

If the original data cannot reject the original hypothesis, one-time difference will be required and the differenced series will be subjected to the ADF test again. We perform this process until the series becomes stable and then build the VAR model. Currently, more than one test can be used to determine the lagging parameter for the model, but the most commonly used criteria are AIC and SIC. The optimal lagging parameter is determined based on the values of the AIC and SIC criteria.

The AIC criteria are calculated as:

where is the lagging parameter, is the sample size and is the sum of the squared residuals.

4.1.3. Impulse response function of the VAR model

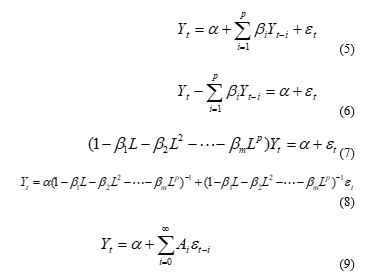

In order to directly observe the interactions between variables, Sims suggests that the Wald decomposition can be quantitatively converted into a moving average representation.

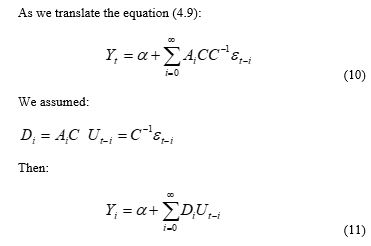

The whole processes are shown below:

From equation (4.9), we conclude that within the VAR model, every variable can be expressed as a linear combination of random shock terms in the current and lagging variables. However, these random shock terms do not have the property of serial correlation, while they may have the property of current correlation. As a result, Sims chose orthogonalization to remove the current correlation.

Based on equation (4.11), it can be observed that each variable can be expressed as a linear combination of the random shock terms in the current and lagging periods, in other words, the impulse response function (IRF). The impulse response function is used to measure the effect of one standard deviation shock from a random disturbance term on the current and future values of the endogenous variables, which can portray the dynamic interactions between variables and their effects in a more intuitive way.

4.2. Prepare for building the model

4.2.1. Some assumptions:

- a) The effectiveness of internet finance is explained by how many users use the service.

- b) The influence of internet finance service on the traditional banking system is measured by the differences in user numbers compared to traditional banking.

- c) We only consider relationships between third-party market scope and traditional banking service market.

4.2.2. Selection of model indicators

- Third-party payment amounts

To better illustrate the impact of internet finance on commercial banks, we take the third-party payment amount indicator, which changes the most in daily life, as an empirical study. This article focuses on the macroscopic effectiveness of internet finance services on the whole traditional banking industry, which includes asset business, intermediate business, and liability business. Among these aspects, the intermediate business of the traditional bank suffers the most. Therefore, we choose third-party payment amount as the independent variable and estimate the effect on the traditional banking industry.

- User statistics for the People’s Bank of China

This indicator measures the macroscopic amount of traditional banking service use, which represents the whole commercial banking accounting service. This service corresponds with the intermediate business of the traditional banking industry, which complies with our research goal.

- The origin and pre-processing of data

The variables selected for the empirical analysis of this paper include third-party payment amount and number of users of the People’s Bank of China. The time period is from the first quarter of 2013 to the third quarter of 2020. This time period is not very long, since China’s internet financial development has only gradually become explicit since 2010. The datasets are from Wind Information and the official website of the People’s Bank of China. To eliminate possible heteroskedasticity in the data, we take the natural logarithm of the above series, and the transformed variables become TP and PC accordingly. The data analysis and processing software used for the empirical analysis of this paper is R.

4.3. Model building and testing

4.3.1. Unit root test

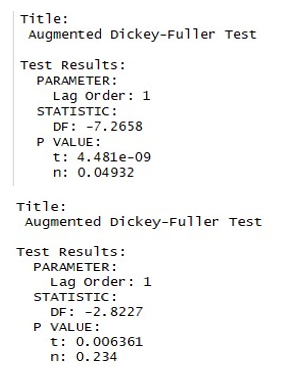

For non-stationary time series, we can first test whether these two series exhibit a cointegration relationship before building a VAR model. Therefore, we first perform a unit root test on the difference between two time series to determine the order of single integers, and Figure 6. shows the test results.

Figure 6: Augmented Dickey-Fuller Test

The number of users with banking accounts passed the unit root test after the first time difference. Third-party payment amount passed the unit root test without difference. Both series indicate that the original hypothesis is rejected at the 5% significance level. Next, we determine whether the two have a cointegrated relationship.

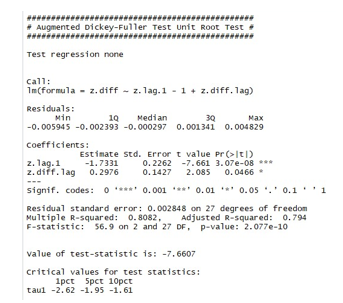

We use the EG two-step method to first obtain the residuals of two time series regressions and then perform a unit root test on them to determine the relationship between them. The following tests are performed:

Figure 7: Augmented Dickey-Fuller Test with the EG two-step method

The results of the tests in Figure 7 indicate that at the 5% significance level, the original hypothesis is rejected, which means that the two variables are cointegrated. Therefore, there is a long-term stable equilibrium relationship, and we use these two series to build a VAR for the original time series model.

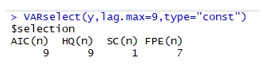

4.3.2 Building the VAR model

Before building the model, the lag order needs to be determined. To find a reasonable order, in this article we apply AIC, HQ, SC, and FPE criteria to ensure the best lag order of the VAR model, and then test results. The results are shown in Figure 8.

Figure 8: VAR model (Maximum lag order test statistic)

We find that for AIC and HQ the best value was 9, while for SC and FPE, the best values were 1 and 7.

Therefore, the next step is to find the best order among those three values. To compare which p value is the best, we depend on log likelihood and the t-value of the residuals of VAR.

Depending on the log likelihood indicator, we find that VAR(9) fits the data best.

Depending on the residuals of the models, we find that VAR(9) brings uncorrelated residuals.

As a result, we use VAR(9) as the analyzing model.

Granger causality test

To determine if the correlation between two variables is meaningful, we also need to perform a Granger causality test. Depending on the result of the Granger causality test we decide the order of the variables when we conduct impulse response analysis.

First, to test whether traditional bank account amount Granger-cause Third party payment amount.

We find that the p-value for the test is 0.582, which means that we cannot reject H0 and that traditional bank account amount Granger-cause Third party payment amount.

Secondly, to test if third party payment amount Granger-cause traditional bank account, we perform the following:

We find that the p-value for the test is 0.4294, which means that we cannot reject H0 and this indicates that third party payment amount Granger-cause traditional bank account amount.

Then, according to this result, the traditional bank account amount should be placed ahead of third party payment amount.

4.3.3 Impulse Response Analysis

By constructing the impulse response function, we see that a certain shock brings some dynamic impact to the system. Based on the VAR model, we obtain the traditional bank account amount and third party payment amount. The following is the impulse of the third-party payment to the traditional bank account:

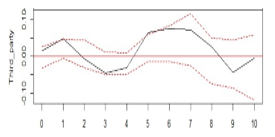

Figure 9: The impulse of the third-party payment to the traditional bank account

Figure 9 represents the bank response path caused by a positive shock to the third-party payment account. From this result, we found that third-party payment changes one unit in periods 1-4 has an increasing negative effect on the bank settlement account, and then in periods 5-8, it maintains a comparatively stable positive effect. This shows that by giving a positive impact to third-party payments, traditional bank account amounts will be impacted in a floating manner, and also demonstrates that the development of the third-party payment market has caused a volatile boost to traditional bank account amounts.

This paper argues that this unstable effect is derived from a “backward mechanism” that arises from the impact of internet finance on commercial banks. For a very long period, commercial banks have acted as money intermediaries. This action artificially divides the market into savings and financing markets, and obtains spreads and commission during this process. However, the emergence of third party payments has changed this traditional function of banks, while it does not substitute for the whole function of traditional banks. Internet finance enables direct transactions between users and suppliers, which directly reduces exchange costs and thus breaks the monopoly of commercial banks. Commercial banks are forced to reduce the cost of capital financing, while improving capital utilization and thus developing higher competitiveness. The emergence of Internet finance has made the financial market more competitive, forcing commercial banks to actively reform and seize market share.

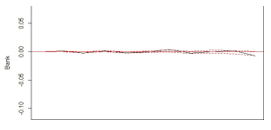

Figure 10: Third party payment response path

The influence of traditional bank accounts on third-party payment

Figure 10 is the third-party payment response path caused by a positive shock to traditional bank account users. Through this observation, we see that when there is one unit change in the traditional bank user account amount, the third-party payment user amount does not respond in periods 1-2, while during periods 3-10, it shows a small increase. However, in the very last period, the figure remains stable. This indicates that the traditional banking system causes a certain positive impact on third-party payment, but the impact is not obvious. This article suggests that internet finance has unique advantages, and it is not easy for traditional commercial banks to significantly influence Internet finance.

4.3.4 Variance Decomposition

We conduct variance decomposition to directly observe the impacts between two variables.

We find that from the very beginning, third party payment does not influence traditional bank account users. Then, after some time passes, third party payment gradually gains great influence over traditional banks. Ultimately, third-party payment exerts 75% influence on traditional bank account users. Therefore, most of the influence on traditional bank account amounts is due to third-party payments.

4.4. Predictions (future development forecasting)

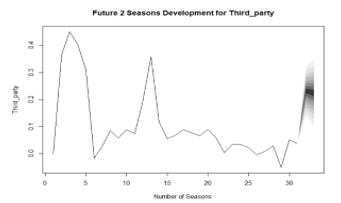

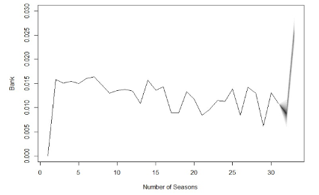

In this part, this article will use results obtained from the VAR model to conduct forecasting analysis for both the traditional banking industry and third-party payment. Using about 30 seasons (3 months per season) of observations, we can predict development for two future seasons (3 months per season).

First, we can examine the forecasting result directly:

Figure 11: Traditional Bank Account Industry

Figure 12: Third-Party Payment Industry

In our analysis, the time unit of the dataset is seasoned, which is shown on the x-axis. Seasonally changing rates are shown on the y-axis, which gives the changing percentage of the industry. (Data used are log-transformed.)

First, this study examines the traditional banking industry and finds that this industry is expected to decrease slightly and then increase very rapidly over about 5 months. Then, the third-party payment industry will first increase and then decrease slowly. The change in rate in the third-party payment industry is much higher than for traditional banking accounts. This indicates that the traditional banking industry is comparatively stable and mature, while the third-party payment industry is new and easily influenced by the outside environment.

5. Conclusion

Based on the results of impulse response analysis, the contribution of current traditional bank accounts to the scale of third-party payment becomes obvious only from periods 8-10. The influence of traditional bank accounts on the scale of the third-party payment industry is not significant. This suggests that traditional bank accounts have very little impact on the separate scale of third-party payments, which bring their own merits that cannot be ignored and have grown rapidly due to the development of internet platforms.

From the aspect of third-party payment, Internet finance has had a significant impact contribution on traditional bank accounts from very early periods that have grown rapidly from periods 5-10, finally reaching about 75%. This shows that third-party payment market size has a significant impact on traditional bank accounts. This phenomenon is inextricably linked to the rapid expansion of the third-party market after 2016.

All of these phenomena indicate that third-party payment has a growing positive impact on the traditional bank account business. This paper argues that the growing scale of the third-party payment market will make the related financial markets more competitive, thus forcing commercial banks to actively innovate and improve their market competitiveness, while the impact of bank settlement business on the third-party payment market remains insignificant. The impulse response plots of the VAR model confirm that there is a correlation between the number of bank settlement accounts and the amount of third-party online payment transactions, and it is not simply negative. In the long run, third-party payments may lead to unstable fluctuations in traditional bank account services.

This result highlights the fact that in the era of “Internet Plus,” internet finance exerts an uncertain effect on the development of commercial banks, and also reveals that commercial banks should have prudent attitudes towards internet finance. Traditional banks should learn from the development of internet finance to enhance their own business in the future.

For future work, further studies are needed to delve deeper into the changing dynamics of the relationship between traditional banks and third-party payments. Specifically, how traditional banks can better adapt to the rising trends of internet finance and maintain stability amidst the rapid growth of third-party payment systems. Furthermore, future perspectives should include an evaluation of policies and regulations that could facilitate a more harmonious development between internet finance and traditional banking.

- Shahrokhi, M., “E‐finance: status, innovations, resources and future challenges,” Managerial Finance, 34(6), 2008, doi:10.1108/03074350810872787.

- Caiquan Bai, Hong Yan, Shanggang Yin, Chen Feng, Qian Wei, “Exploring the development trend of internet finance in China: Perspective from club convergence,” The North American Journal of Economics and Finance, 58, 2021, 1062-9408, doi:10.1016/j.najef.2021.101505.Yuk-shining

- Onay, C., Ozsoz, E, “The Impact of Internet-Banking on Brick and Mortar Branches: The Case of Turkey,” J Financ Serv Res, 44, 2013, doi:10.1007/s10693-011-0124-9.

- C Yuk-shing Cheng, “China’s Reform of Rural Credit Cooperatives: Progress and Limitations,” The Chinese Economy, 39(4), 2006, doi:10.2753/CES1097-1475390402.

- Brigit Helms, “Access for All : Building Inclusive Financial Systems,” World Bank Publications, 2006

- Loubere, Nicholas, “Indebted to Development: Microcredit as (De)marginalisation in Rural China,” Journal of Peasant Studies, 2016, doi:10.1080/ 03066150.2016.1236025.

- Loubere, N, Zhang, HX, “Co-operative financial institutions and local development in China,” Journal of Co-operative Organization and Management, 3(1), 2015, doi:10.1016/j.jcom.2015.03.001.

- Rongda Chen, Huiwen Chen, Chenglu Jin, Bo Wei, Lean Yu, “Linkages and Spillovers between Internet Finance and Traditional Finance: Evidence from China,” Emerging Markets Finance and Trade, 56(6), 2020, doi:10.1080/1540496X.2019.1658069.

- Xu, Y., “Design and research of bank Internet financial product pricing model,” Cluster Computing, 22(6), 2019, doi:10.1007/s10586-018-2456-9.

- Lee, Chi-Chuan, Li, Xinrui, Yu, Chin-Hsien, Zhao, Jinsong, “Does fintech innovation improve bank efficiency? Evidence from China’s banking industry,” International Review of Economics & Finance, 74(4), 2021, doi:10.1016/j.iref.2021.03.009.

- Li, Chengming, He Si, Tian Yuan, Sun Shiqi, Ning Lu, “Does the bank’s FinTech innovation reduce its risk-taking? Evidence from China’s banking industry,” Journal of Innovation & Knowledge, 7, 2022, doi:10.1016/j.jik.2022.100219.

- Baomin Chen, Xinyun Yang, Zhenzhong Ma, “Fintech and Financial Risks of Systemically Important Commercial Banks in China: An Inverted U-Shaped Relationship,” Sustainability, 14, 2022, doi:10.3390/su14105912.

- Niu, Yitong, Linqian Jiao, Andrei Korneev, “Credit Development Strategy of China’s Banking Industry to the Electric Power Industry,” Heritage and Sustainable Development, 4(1), 2022, doi:10.37868/hsd.v4i1.81.

- K. Chan, Philip Gray, “Using extreme value theory to measure value-at-risk for daily electricity spot prices,” International Journal of Forecasting, 22, 2009, doi:10.1016/j.ijforecast.2005.10.002.

- R. TREVOR, Thorp, Susan, “VAR Forecasting Models of the Australian Economy: A Preliminary Analysis,” Australian Economic Papers, 27, 2008, doi:10.1111/j.1467-8454.1988.tb00697.

- C. Brooks, Clare, A.D., Molle, J.W., Persand, G., “A comparison of extreme value theory approaches for determining value at risk,” Journal of Empirical Finance, 12, 2005, doi:10.1016/j.jempfin.2004.01.004.

- G. Persand, Chris Brooks, “Volatility Forecasting for Risk Management,” Journal of Forecasting, 22, 2003, doi:10.1002/for.841.