Non–Performing Loans’ Effect on the Loans’ Shrinkage in Albanian Banking Sector

Volume 6, Issue 1, Page No 961-967, 2021

Author’s Name: Arjan Tushaj1, Valentina Sinaj2,a)

View Affiliations

1Faculty of Economics, Department of Economics, University of Tirana, Tirana, 1000, Albania

2Faculty of Economics, Department of Applied Statistics and Informatics, University of Tirana, Tirana, 1000, Albania

a)Author to whom correspondence should be addressed. E-mail: sinajv@yahoo.com

Adv. Sci. Technol. Eng. Syst. J. 6(1), 961-967 (2021); ![]() DOI: 10.25046/aj0601106

DOI: 10.25046/aj0601106

Keywords: Non – performing loans, Loans’ growth, Optimum loans

Export Citations

The article investigated the banking determinants of loans’ growth using the quarterly data of Albanian banking sector during 2003-2018. We estimated the linear model of control variables to examine the bank’s sound effects on loan’s capacity. Empirical results demonstrated the initial positive outcome of the growth of non – performing loans on the loans’ growth, but negative effect incorporating with the structural changes. This divergence emphasized the optimum loans’ supply through the existence of U relationship amongst them and confirming the banking shrinking behavior related to the lending policy. Also, we confirmed the negative impact of capital regulation and long run correlation to capital regulation growth and growth ratio of loans.

Received: 06 December 2020, Accepted: 24 January 2021, Published Online: 12 February 2021

1.Introduction

The economic progress of emerging economies affected by bank lending to attain the essential growth. Otherwise, the lending activity demonstrated the convinced hazard due to the bad credits and it would be one more reason to examine and to assurance the quality of lending in banking sector. The lending activity in banking sector associated with more theoretic and practical investigations particularly to the evolving economies past to the 2008’s crisis. These investigations focused to the examination of theoretic and practical assessments according to the bad credits due to the borrower’s defaulting. The bank lending has no option to avoid completely the phenomena of adverse selection and moral hazard. In [1], the authors analyzed the determinants of banking credit related to the emergent economies before and after the periods of 2008’s crisis. They emphasized that the national and foreign funding affected positively the credit growth. Also, authors concluded that the economic growth, inflation growth and loose monetary policy induced the credit’s increase. Meanwhile in [2], the authors examined the determinants of lending activity of banking sector pre – global crisis and post – global crisis in Central Eastern and Southeastern European countries. They emphasized that the economic growth, credit quality, financial intermediation level and foreign and domestic financing sources affected the credit’s expansion.

The author in [3] analyzed the linkage among the cost’s efficacy and non – performing credits related to banking sector in Zimbabwe during 2009 – 2014. Author concluded the inefficiency of credit managers related to the non – performing growth. He recommended to applying the international best practical approach by credit managers in order to avoid the fragile policy and detrimental impact in long run on the banking loan’s quality. His results approved the bad management hypothesis. Also, [4] highlighted that the significance of banking supervision joining to the large activities restrictions and expanding the market power decreased thoughtfully the threat of banking failure. These outcomes proved that banking procedures marked synchronously the banking effective environment and the banking performance.

The banking sector in Albania has been operated into a dynamic growth and induced the more exertions by banks to take the more appropriate position in the market. This goal of banks induced the enlarge lending strategy contributing to the increasing of non- performing loans ratio. These surroundings marked by the precise banking determining factors, mostly the decision – making procedures and the macroeconomic changes. Otherwise, these outcomes relied to the performance of principal economic segments.

The article followed by this structure: First section included the outline. Section 2 provided the literature review according to the determinants of bank lending and the linkage with non- performing loans. Section 3 demonstrated the empirical view related to banking loan’s growth and non – performing loans in Albanian banking sector. Section 4 analyzed the description of econometric methodology and empirical results using in this article. The last section summarized the last remarks of this article.

2. Literature Review

The bank lending has always correlated with several kinds of banking risks which they investigated according to the theoretic and practical background of banking sector. This examination will focus to hypothetical and applied evaluations related to the determinants of bank loan’s growth and the effect of non-performing loans to banking behavior related to lending. The bank lending has always associated with the phenomena of adverse selection and moral hazard.

In [5], the author examined the non-performing loans’ effect towards the loan growth. He highlighted the banking lending behavior could restrain the economic activity particularly during the stress periods linked to the large ratios of non – performing loans. His outcomes using regression analysis concluded the robust effect of non – performing credits ratios on the loaning decisions referring to the upper and under threshold.

In [6], the author investigated the factors of banking loan related to 146 states during 1990 – 2013. His empirical results suggested the crucial effects of economic growth and healthy domestic banking sector related to bank lending. He highlighted that the dependence of foreign capital inflows exposed the domestic banking sector to external shock and faced to credit boom – bust cycles.

In [7], the author estimated the determining factors of lend evolution in Montenegro related to the demand stimulus and supply stimulus simultaneously. She confirmed that the positive economic developments and increasing banks’ deposits potential induced the credit growth. Also, she emphasized that the bad credits and low soundness ratio affected negatively the lend supply and banking sector soundness was more influential according to the promoting of banks’ lending. She found that the significance of supply factors related to credit growth during the post –crisis, meanwhile she provided the significance of both supply and demand factors to explain the credit growth during pre- crisis.

In [8], the author investigated the Italian bank lending behavior during financial crisis if the increase of credit risk would reduce the bank lending. Also, she analyzed the cooperative and commercial banks behaviors related to lending activity during 2007 – 2103. She found the negative impact linked to the bad loans and ratio of credit loss provision like the measurement of credit risk on bank lending behavior.

In [9], the authors investigated the endogenic and exogenic determinants related to the loan growing in selected Western Balkan economies and Turkey through a multiple regression analysis during 2007 – 2017. Their results emphasized the reverse relationship between non – performing credits ratio and credit rising’s ratio according to each economy. Also, they concluded the positive effects of economic growth and deposits growth ratio on banking credit growth for all sample, except Croatia which it demonstrated the positive effect of return on equity on it.

In [10], the authors analyzed the impact of nonperforming loans (NPLs) related to the banking loan supply towards the nonfinancial businesses in Italy during 2008 – 2015. They found that the banks’ lending behavior did not affect by NPL ratios using time-varying firm fixed effects to control meant for demand shifts and changes related to the borrower characteristics. Their results demonstrated the negative correlation among NPL ratios and loan growth. Although the exogenous appearance of new NPLs and the linked enhance within provisions could reflect the negative adjustment in loan supply.

In [11], the authors investigated the credit growing and banking behavior according to risk-taking during the expansive lending of 2006 – 2014 in Pakistan. They confirmed the loan’s growth associated with increasing bad credits and decreasing the bank’s creditworthiness due to the frail provident guideline amongst participants and unequal information of debtors, particularly the underestimated risk of lending through credit booms.

In [12], the authors investigated the determining factors of banking loan to business sector and they found the positive relationship among bank lending and economic growth according to Albanian banking sector. Also, they found that banking and financial intermediation and financial liberalization induced the increasing of lending demand. Authors emphasized the positive effect of exchange rate on banking loan and negative impact of crowding – out effect on it in the long run. Also, they concluded that the decreasing of bad loans and loaning’s efficiency increased the loan’s supply.

In [13], the author investigated the results of tight lending into banking sector related to innovation relying on German firms’ data. Author confirmed the restriction of firms’ capacity to enhance their external financial sources through banking sector during the financial crisis. He emphasized the increasing of firm’s probability related to suspending innovation projects due to tight policy of banking sector and its negative outcome in long run.

Theoretic outcomes and functional results proved the convergence of non – performing loans towards the loans’ ratios in banking sector despite of diverse backgrounds.

3. Loans growth and non-performing loans in Albanian banking sector

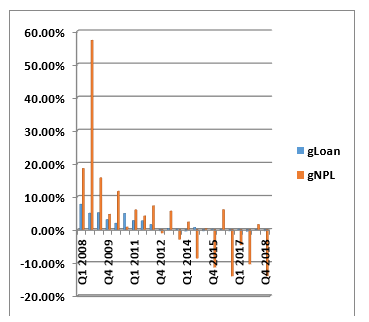

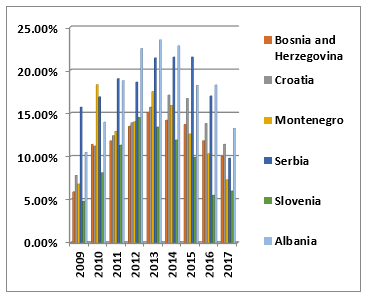

The banking solidity in Albania has sustained despite of sporadic tremors linked to effects of 2008’s crisis. Figure 1 confirmed the subtleties of the growing ratio of non-performing loans and total gross loans during 2008 – 2018 relied on trimestral figures. According to the figure 1 the non – performing loans linked to the explosive propensity leading by the descendent propensity, especially after last quarter of 2008. The last quarter of 2008 demonstrated the outlier highlighting the contagious effects of 2008’s crisis in Albanian banking sector and political cycles. Meanwhile the downward trend of non-performing loans’ growing ratio related to the restrictive banks’ loaning policy and the loans’ rearrangement by the involvement through Bank of Albania. However, the flat propensity of loans’ growth ratio affected by the restricted loaning policy of banks due to the increasing ratio of bad credits to total gross loans after 2008. The growth ratio of whole loans associated with the convergent trend toward zero percentage, but the growth ratio of non-performing loans ratio linked to divergent trend compare to loan’s growth ratio. Meanwhile the figure 2 demonstrated the comparative analysis amongst Western Balkan countries related to non – performing loans into banking sector during to 2009 – 2017. Figure 2 highlighted the upward trend of non – performing loans for each Western Balkan until 2013. It confirmed the largest ratio for Albania and Serbia until 2016 compare to others countries, especially Albania along entire period despite of trend and volatility.

Figure 1: Growth rates of non-performing loans and total loan in banking sector, Source: Authors’ calculations on dataset of Bank of Albania

Figure 1: Growth rates of non-performing loans and total loan in banking sector, Source: Authors’ calculations on dataset of Bank of Albania

Figure 2: Non-performing loans ratios in banking sector of Western Balkan countries, Source: Central banks of individual countries

Figure 2: Non-performing loans ratios in banking sector of Western Balkan countries, Source: Central banks of individual countries

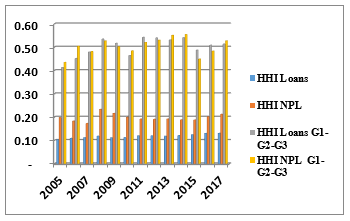

However, the banking sector in our country runs into a progressive growth and persuades the extra controls by banks concluding to their conduct. The banking concentration has contributed to the common advancement of banking sector. Figure 3 demonstrated the banking concentration using Herfindahl–Hirschman Index (HHI) related to the total loans and non – performing loans in the banking sector through individual banks and banks’ size (G1, G2 and G3) during 2005 – 2017. It exposed the stability of the loans’ concentration and non – performing loans’ concentration relied on individual banks along this period. Despite of convergence related to moderated concentration, non – performing loans demonstrated the higher concentration compare to loans according to individual banks. Meanwhile the concentration of total loans and non – performing loans through banks’ size demonstrated the large values and approximately identical values during the specified period. Also, the concentration related to banks’ size revealed the similar propensity according to total loans and non – performing loans despite of slight volatility, but higher concentration and large gap compare to the concentration of individual banks.

Figure 3: Concentration of loans and non-performing loans ratios in Albanian banking sector Source: Authors’ calculations on dataset of Bank of Albania

Figure 3: Concentration of loans and non-performing loans ratios in Albanian banking sector Source: Authors’ calculations on dataset of Bank of Albania

4. Methodology and empirical results

4.1. Data description and econometric methodology

The loans’ growth estimated to the linear model by least squares method referring on the quarterly data of Albanian banking sector during 2003-2018. The general linear model is following:

![]() for t=1,…,64, and the residual completed the Ordinary Least Squares assumption and [14].

for t=1,…,64, and the residual completed the Ordinary Least Squares assumption and [14].

![]() The linear model includes the variables controlling for bank sound effects on loan’s capacity. The model used the growth ratio of banking control variables including the non-performing loans’ growth (G_NPL), deposit’s growth (G_Deposit), regulator capital’s growth (G_Cap.Reg.) and return on equity (ROE). We expected the negative relationship among growth of non- performing loans and loans’ growth supporting by theoretical and empirical view. Meanwhile we should investigate the U-shaped relationship between loans’ growth and non – performing loans’ growth supporting by the empirical model [5]. Ambiguous results of this correlation clarified the inverted conduct through the optimum of loans’ growth affecting by non performing loans’ growth. Furthermore, we expected the positive impact of return on equity related to the loans’ growth due to profitability in order to maximize banking profitability. Also, we expected the positive effect of deposits’ growth on the loans’ growth due to the deposits meant the probable loans’ capacity and loans’ source for banking sector. Moreover, the indicator of regulatory capital anticipated the negative outcome due to the banking capability to cover with capital the losses’ risk exposure by the bad loans. This expectation supported that the capital rigidity merely confirmed the frail negative results on loan’s growth, but the components of capital rigidity demonstrated the strongest negative effect related to loan’s growth [15]. Also, the regulatory capital required the comprehensive fulfilment the Basel’s criterions in order to be the well – capitalized banks and consequently inducing the banks’ lending shrinkage. We proved our expectations related to the variables’ impact on the loans’ growth using R software.

The linear model includes the variables controlling for bank sound effects on loan’s capacity. The model used the growth ratio of banking control variables including the non-performing loans’ growth (G_NPL), deposit’s growth (G_Deposit), regulator capital’s growth (G_Cap.Reg.) and return on equity (ROE). We expected the negative relationship among growth of non- performing loans and loans’ growth supporting by theoretical and empirical view. Meanwhile we should investigate the U-shaped relationship between loans’ growth and non – performing loans’ growth supporting by the empirical model [5]. Ambiguous results of this correlation clarified the inverted conduct through the optimum of loans’ growth affecting by non performing loans’ growth. Furthermore, we expected the positive impact of return on equity related to the loans’ growth due to profitability in order to maximize banking profitability. Also, we expected the positive effect of deposits’ growth on the loans’ growth due to the deposits meant the probable loans’ capacity and loans’ source for banking sector. Moreover, the indicator of regulatory capital anticipated the negative outcome due to the banking capability to cover with capital the losses’ risk exposure by the bad loans. This expectation supported that the capital rigidity merely confirmed the frail negative results on loan’s growth, but the components of capital rigidity demonstrated the strongest negative effect related to loan’s growth [15]. Also, the regulatory capital required the comprehensive fulfilment the Basel’s criterions in order to be the well – capitalized banks and consequently inducing the banks’ lending shrinkage. We proved our expectations related to the variables’ impact on the loans’ growth using R software.

4.2. Results of examination

We used the “Student test” related to the significance of coefficients’ model. The null hypothesis demonstrated the non – significance of variable, and if the p-value of “T test” was less than the significance level meaning the rejection of null hypothesis. Meanwhile the model’s significance was testing by Fisher statistics meaning the null hypothesis related to non – significance of model. Table 1 demonstrated the statistical significance of model and variables. Referring to the p-values we confirmed that the model was significant and all of variables were significant according to 5% level despite of ROE. The only non-significant variable was ROE, which it resulted to p-value of 6.8%. We selected the good – fit model using stepwise method based on the model selection criteria. We choose the model with the highest value of adjusted R2 and related to Information Criteria, Akaik criterion (AIC, [16]), and Baeysian criterion [17], we decided the model with the smallest value of each criterion. Referring to the selection of regression Mallow’s criterion [18], if the model is correct then Cp will tend to be close to or smaller than p. We used R software according to the whole evaluations and selections.

Also, we used variables and their lags and investigated the structural break[1] according to first quarter of 2008. Due to this reason, we used the dummy variable for year 2008 (value 1 before this moment and otherwise zero after this moment) related to the growth of non-performing loans and ROE. We applied several tests to examine the significance and consistence of model (see more details for results of tests in the appendix (table 2-5)). The estimated results referring to table 1 demonstrated the initial positive effect of non – performing loans’ growth on the loans’ growth. Otherwise, when we incorporated both the structural changes using dummy variable with non – performing loans’ growth, we observed the negative effect of non – performing loans’ growth. This result emphasized the change of banks’ behavior related to loans’ supply meaning the demonstration of U-form relationship among loans’ growth and non – performing loans’ growth.

The outcome supported the several empirical results due to contagious effect of 2008’s crisis linked to the structural deviations. Meanwhile our estimated outcomes verified the positive correlation amongst the growth of credits and deposits due to the deposits remain the main banking loans’ source. Banks inclined to increase the loans’ supply in order to add to their interest incomes and to maximize their profitability. This result supported our expectations and theoretical and empirical views. Also, ROE demonstrated the positive effect on the loans’ growth and has continued the similar effect when we incorporated both the structural changes using dummy variable with ROE. This effect explained by banks’ propensity to enhance the loans’ supply due to higher profitability. Empirical results have testified the sustainable ROE’s effect on loans’ growth despite of structural changes due to 2008’s crisis. Otherwise, our estimations proved the adverse effect of regulatory capital on the loans’ growth. This result supported other empirical outcomes and converged to banks’ lending shrinkage towards the intended well – capitalized banks due to rigid Basel’s standards and contagious effects of 2008’s crisis.

Table 1: Estimated results

| Coefficients: |

| Estimate Std. Error t value Pr(>|t|) |

| (Intercept) 0.04841 0.01818 2.663 0.010045 * |

| G_NPL 0.13796 0.03629 3.802 0.000352 *** |

| G_Deposit 0.33138 0.14747 2.247 0.028518 * |

| ROE 0.13613 0.07330 1.857 0.068475 . |

| G_Cap.Reg. -0.33869 0.09508 -3.562 0.000751 *** |

| G_NPL*D -0.21776 0.05355 -4.067 0.000148 *** |

| ROE*D 0.42841 0.06424 6.669 1.13e-08 *** |

| Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1 |

| Residual standard error: 0.0252 on 57 degrees of freedom |

| Multiple R-squared: 0.7948, Adjusted R-squared: 0.7732 |

| F-statistic: 36.79 on 6 and 57 DF, p-value: < 2.2e-16 |

Source: R, authors’ estimations

In [19], the author emphasized if two time series have stochastic trends (i.e., they are nonstationary), a regression of one other may cancel out the stochastic trends, which it may advice the coexistence in the long-run, or equilibrium, among them even though individually the two series are nonstationary. We verified the stationarity of series using Augmented Dickey-Fuller test[2] (ADF) to determine the presence of unit roots. According to the ADF test, the null hypothesis is the series has a unit root. We used T-test to test the hypothesis and if the p-value was less than 5% significance level than null hypothesis rejected. Table 8 demonstrated the results of ADF test and it confirmed three series which they were the first order integration or I(1), particularly series of ROE, G_L and G_Cap.Reg. According to [20], the economic interpretation of cointegration states that if two (or more) series are linked to form an equilibrium relationship spanning the long run, then even though the series themselves may contain stochastic trends and thus be non-stationary, they will nevertheless move closely together over time and the difference between them will be stable or stationarity.

We examined the long run relationship amongst variables’ series through the co-integration procedure using Granger causality test[3] to investigate empirically the direction of relation between variables. The null hypothesis emphasize that the first variable demonstrates no Granger causality to the second variable. The null hypothesis rejects, if p-value of Fisher test is less than the significance level. Table 9 demonstrated the empirical results of Granger causality test and it confirmed the short run relationship amongst variables, ROE, G_L and G_Cap.Reg at 10% level of significance.

Meanwhile the Johansen Procedure is used for co-integration of three non-stationary series, ROE, G_L and G_Cap.Reg. According to the results of Trace statistic in table 10 and their critical value, we confirmed only one couple of series which are co-integrated. Table 11 related to Engel – Granger procedure with one-equation, we derived one coupled variable which they were co-integrated, precisely the loans’ growth and the growth of capital regulation demonstrated the long run correlation. This result emphasized the significance of capital regulation to take into more considerations by banking managers and policy makers due to its impact in long run. Also, we investigated the U shape relationship amongst loans’ growth and non – performing loans’ growth[4]. We calculate the minimum (turning point) of the parabola defined as in which corresponds to the averaged level loans’ growth and non – performing loans’ growth. The second order polynomial demonstrated its general form through the following equation:

f(x)=ax2+bx+c where xϵ (0; +∞) and at least a≠0. Thus, the minimum (turning point) is defined as: .

![]() Otherwise, it can be calculated by using the first derivative of function f(x): f’(x)=2ax+b and by solving the equation: f’(x)=2ax+b=0. The solution of second equation estimated the level of non – performing loans’ growth. Related to the threshold at which the relationship among the loans’ growth and non – performing loans’ growth turns from positive to negative. The empirical results of table 12 demonstrated the optimum value of loans’ growth by 321 basis points when we included the structural changes of 2008’s global financial crisis. This result explained the negative impact pending the non – performing loans’ growth ratio and the loans’ growth curvature was curved to 321 basis points due to the structural break point of 2008. The propensity of banks’ behavior adjusted subsequent to optimum point in order to compensate the loss due to non – performing loans. Also, this result confirmed the banking shrinking behavior correlated to the lending policy consequently of non – performing loans subsequent to optimum loans.

Otherwise, it can be calculated by using the first derivative of function f(x): f’(x)=2ax+b and by solving the equation: f’(x)=2ax+b=0. The solution of second equation estimated the level of non – performing loans’ growth. Related to the threshold at which the relationship among the loans’ growth and non – performing loans’ growth turns from positive to negative. The empirical results of table 12 demonstrated the optimum value of loans’ growth by 321 basis points when we included the structural changes of 2008’s global financial crisis. This result explained the negative impact pending the non – performing loans’ growth ratio and the loans’ growth curvature was curved to 321 basis points due to the structural break point of 2008. The propensity of banks’ behavior adjusted subsequent to optimum point in order to compensate the loss due to non – performing loans. Also, this result confirmed the banking shrinking behavior correlated to the lending policy consequently of non – performing loans subsequent to optimum loans.

5. Concluding remarks

The propensity of the growing ratio linked to the non-performing loans and total gross loans in Albanian banking sector during 2008 – 2018 has sustained its stability excluding the effects of contagious effects of global financial crisis, particularly subsequent to last quarter of 2008. The growth rate of total loans and non-performing loans ratio diverge amongst them during this period. This divergence described by the restraining loaning strategy of banks and the credits’ restructuring through Bank of Albania contribution. Meanwhile Albania demonstrated one of the largest ratios of non – performing loans into banking sector during to 2009 – 2017 despite of volatility referring to the comparative analysis amongst Western Balkan countries. Also, the non – performing loans and loans converged to the moderated concentration related to individual banks even though the high concentration of non – performing loans compare to the loans. However, the total loans and non – performing loans correlated to banks’ size demonstrated the high concentration compare to the individual banks’ concentration. This discrepancy justified the tight lending policy due to the increasing propensity of non – performing loans’ concentration by banks’ size.

We examined the initial positive outcome of growth ratio linked to non – performing loans towards the loans’ growth. Meanwhile we tested the negative effect of non – performing loans’ growth related to the dual incorporation by dummy variable of the structural changes. Ambiguous results confirmed by the contagious effect of 2008’s crisis linked to the structural changes. This reversal of behavior confirmed the optimum of loans’ growth affecting by non-performing loans’ growth.

The optimum break demonstrated the U shape relationship amongst loans’ growth and non – performing loans’ growth through empirical result and explained the dual effect. The negative relationship was curved to the optimum of loans’ growth by 321 basis points incorporating the structural break of 2008’s global financial crisis. The propensity of banks’ behavior adjusted subsequent to optimum loans to compensate the loss due to non – performing loans and converged to the banking shrinking behavior correlated to the lending policy. Policymakers should be monitoring continuously the non-performing loans’ growth in the forthcoming to control the optimal loans’ growth ratio.

The regulatory capital illustrated the negative effect on the loans’ growth and proved the convergence to banks’ lending shrinkage to retain the well – capitalized banks due to rigid Basel’s standards and contagious effects of 2008’s crisis. Empirical result tested the long run correlation amongst growth of loans and growth of capital regulation and highlighted to take into more considerations related to the capital regulation by banking managers and policy makers.

Meanwhile the deposits growth demonstrated the positive effect on the loans’ growth confirming the core source of banking loans’ supply. Furthermore, ROE confirmed the dual positive effect on the loans’ growth with and without incorporation of the structural changes. This effect explained the banks’ propensity to enhance the loans’ supply due to higher profitability and testified the sustainable ROE’s effect despite of 2008’s crisis.

- K. Guo, V. Stepanyan, “Determinants of Bank Credit in Emerging Market Economies,” IMF Working Paper, WP/11/51, 2011.

- S. Note, E. Suljoti, “Assessment of banks’ lending determinant in Central Eastern and Southeastern European countries,” Working Paper, Bank of Albania, 2017.

- S. Abel, “Cost efficiency and non-performing loans: An application of the Granger causality test,” Journal of Economic and Financial Sciences, 11(1), May 2018, doi: 10.4102/jef.v11i1.170.

- G. Jiménez, J.A. Lopez, J. Saurina, “How Does Competition Impact Bank Risk-Taking,” Journal of Financial Stability, 9(2), 185-195, 2007, doi:https://doi.org/10.1016/j.jfs.2013.02.004.

- M. Tracey, “The Impact of Non-performing Loans on Loan Growth: an econometric case study of Jamaica and Trinidad and Tobago,” WP, September 2011.

- T. H.H. Pham, “Determinants of Bank Lending,” May 2015, hal-01158241, Available at: https://hal.archives-ouvertes.fr/hal-01158241.

- M. Ivanović, “Determinants of Credit Growth: The Case of Montenegro,” Journal of Central Banking Theory and Practice, 2016, 2, 101-118, 2016.

- D. Cucinelli, “The Impact of Non-performing Loans on Bank Lending Behavior: Evidence from the Italian Banking Sector,” Eurasian Journal of Business and Economics 2015, 8(16), 59-71, 2015.

- A. Alihodžić, I.H. Ekşi, “Credit growth and non-performing loans: evidence from Turkey and some Balkan countries,” Eastern Journal of European Studies, 9(2), 229-249, 2018.

- M. Accornero, P. Alessandri, L. Carpinelli, A.M. Sorrentino, “Non-performing loans and the supply of bank credit: Evidence from Italy,” Questioni di Economia e Finanza (Occasional papers), 374, 2017, doi: 10.2139/ssrn.2954995.

- M. Kashif, S.F. Iftikhar, K. Iftikhar, “Loan growth and bank solvency: Evidence from the Pakistani banking sector,” Financial Innovation, 2016.

- G. Shijaku, I. Kalluci, “Determinants of Bank credit to the Private sector: The case of Albania,” Working Paper, Bank of Albania, 2013.

- S. Kipar, “The Effect of Restrictive Bank Lending on Innovation: Evidence from a Financial Crisis,” Ifo Working 39, 2011.

- F.J. Fabozzi, S.M. Focardi, S.T Rachev, G.A. Bala, “The Basics of Financial Econometrics,” John Wiley & Sons Inc., 2014.

- Y. Deli, I. Hasan, “Real effects of bank capital regulations: Global evidence,” MPRA Paper, No. 79065, 2017, https://mpra.ub.uni-muenchen.de/79065/

- H. Akaike, “Information theory and an extension of the maximum likelihood principle,” 199-213, 1973. In B. N. Petrov & B. F. Csaki (Eds.), Second International Symposium on Information Theory, 267–281. Academiai Kiado: Budapest.

- G. Schwarz, “Estimating the Dimension of a Model,” Annals of Statistics, 6, 461-464, 1978.

- C.L. Mallows, “Some Comments on Cp.,” Technometrics, 15, 661-675, 1973.

- D.N. Gujarati, D.C. Porter, “Basic Econometrics,” Fifth Edition, McGraw-HILL International Editions Economics Series, Singapore, 2009.

- M.N. Harris, L.R. Macquarie, “A comparison of some introductory and undergraduate econometric textbooks,” Journal of Economic Surveys, September 1995

Citations by Dimensions

Citations by PlumX

Google Scholar

Crossref Citations

- Sauda Nerjaku, Valentina Sinaj, "A VAR Model for Non-Performing-Loans in Albania." European Modern Studies Journal, vol. 8, no. 4, pp. 422, 2024.

- Kepas Antoni Adrianus Manurung, Hermanto Siregar, Idqan Fahmi, Dedi Budiman Hakim, "Sustainable Value Chain for Sustainable Lending of State-Owned Banks in Indonesia." Sustainability, vol. 16, no. 12, pp. 4940, 2024.

No. of Downloads Per Month

No. of Downloads Per Country