The Role of Promotion in Mobile Wallet Adoption – A Research in Vietnam

Volume 5, Issue 6, Page No 290–298, 2020

Adv. Sci. Technol. Eng. Syst. J. 5(6), 290–298 (2020);

DOI: 10.25046/aj050635

DOI: 10.25046/aj050635

Keywords: Mobile wallet, Mobile payment, Digital economy

Mobile wallet is an application that allows users to make online payments using their mobile phones. In the context of an outbreak of COVID-19 epidemic in Vietnam and the world, mobile wallets are considered having many opportunities to change people’s cash spending habits. The current study assesses the factors impact on the intention to use the mobile wallet, focusing on understanding the relationship of promotion with common factors in technology adoption research such as perceived risk, perceived usefulness, habits, social influences. The research results also show the direct and indirect effects of promotion on intent to use. From this result, 7 of 9 research hypotheses were accepted. Promotion, often overlooked by researchers, has been proven to be a critical factor when researching technology adoption because it significantly improves the level of intentional interpretation of the research model. This study will be the premise for future researches when studying adoption technology, researchers could integrate promotion to the model to achieve a significant improvement in the level of interpretation as showed in this study.

1. Introduction

PricewaterhouseCoopers (PwC) survey in 27 countries recorded Vietnam as the fastest growing mobile payments market in 2018, with the percentage of users increasing from 37% to 61% [1]. Facing increasingly complicated developments of the COVID-19 epidemic, the Vietnam’s Government has also recommended people to limit cash payment and increase the use of online payment services to decrease the risk of infection. As a result, cashless payment methods, including mobile wallets, have a great opportunity to become more and more popular. In Vietnam, the ratio of non-cash payments to the total means of payment is only 14%, so the scope for growth of mobile wallets is huge. This context has created many favorable conditions to help mobile wallets develop and increasingly change the cash using habits of most Vietnamese people, actively contributing to bringing Vietnam towards the cashless economy [2].

Mobile payment means all payment services are made through mobile devices such as laptops, tablets or smartphones. Among them, mobile wallets are the latest e-commerce method that helps customers to make payment, shopping online, booking and share services. In terms of technology, a mobile wallet is an application installed in a smartphone or a tablet which allows consumers to input money and make online payments directly with the mobile wallet [3]. Mobile wallets can also be recognized as the revolution derived from e-wallets. Owning a wide ecosystem is a way of integrating into the digital transformation stream of users, especially young people who love technology. Because of the nature of mobile wallets, it is convenient, fast and secure in payment for daily activities, reducing the risks associated with spending and managing cash.

Although the application of technology has received long-standing attention from the government, it has not developed to achieve the desired scale, required for application in the entire systems payments in Vietnam. Vietnamese clients still prefer to use cash, reflected in the fact that there are still nearly 90% of transactions are paid by cash. Until now, almost no scholars doing research on mobile wallet in Vietnam whereas Vietnam is one of fastest growth in Asia area and is considered as a very attractive market for investors in all fields, especially technological payment. This study was carried out to fill the research gap in Vietnam related to mobile wallet.

This research aims to explore the factors affecting the intention to use of mobile wallet in Vietnam. The results are expected to provide the suggestions for mobile wallet suppliers to reach customers more effectively, and policymakers to drive a cashless economy in Viet Nam. In addition, the role of promotion demonstrated in this study will be the premise for future researches when studying the adoption of technology, researchers could integrate promotion to the model to achieve a significant improvement in the level of interpretation as showed in this study.

We divided the content of this paper into five parts: The first part focuses on statement problem and meaning of this study comparing previous researches. Part two presents theories related study topic and constructing framework model. Besides that, authors have description research method and sampling characteristic in part three. To test the relationship between factors in the proposed model, we have showed analysis and results in part four and the last part is summary research results and implications.

2. Theoretical background and research framework

2.1. Theoretical background

Vietnam belongs to the group of countries with a high percentage of internet users (70.3%), equivalent to 68.5 million Internet users in 2019. With 43.7 million smartphone users (accounting for 45% of the population in 2019), Vietnam are at the regional average, higher than India, the Philippines, Indonesia and Thailand. Many advanced technologies are being applied such as biometric authentication such as fingerprint, face; quick response code (QR Code); Tokenization of information[4].

The development of technology, the popularity of the internet and smartphones has progressively increased the demand for cashless and digital transactions around the world. Customer attitudes and acceptance regarding mobile payments have also experienced a drastic change [5]. Many studies around the world have also confirmed that customers like technologies that can provide fast, useful services on a mobile platform. Mobile payment services, in which mobile wallets are one of the latest advances in the digital economy, have integrated these features [6, 7, 8].

Mobile wallet is one technology that have many growth opportunities in this condition [9]. Mobile wallets could replace physical wallets and even debit or credit cards in online and direct purchases. We see this technology as a major revolution in the digital economy because in the era of technological revolution, the issues of speed, interoperability, security and privacy of mobile technology have been resolved. In our study, we proposed and tested a research framework model which combined constructs in the TAM and UTAUT models, expanding with new variables for a transitional country like Vietnam such as promotion, a construct built from practice.

Promotion

Promotion is considered as a short-term marketing strategy and used to create awareness and interest in products or services. It helps the companies to attain sales and marketing goals [10]. Moreover, promotion could affect to the consumer’s mind like a benefit to him/her, then creating the changes in consumer behavior [11]. Many studies have also confirmed the effect of sales promotions on consumer attitudes and consumer behavior [12, 13, 14]. As a result, promotion is a very useful strategic mean to improve profitability. Sellers are using various promotion strategies, for example coupons, product upgrades, price reduction, free samples and free gifts to increase intention to buy of customers. Promotion can be separated into non-financial and financial promotions [15]. The examples of financial promotions are discount of prices, coupons and vouchers while promotions related non-monetary include bonus products and gifts. The value of the promotion is also perceived relatively [16]. Customers could recognize a monetary promotion as a decline in losses because of this kind of promotion brings a reduction in the purchase cost that consumers have to pay. In contrast, promotion of non-monetary sales could be considered as a profit from the deal [17].

Related to the financial and payment sector, [18] showed the influence of sales promotion to persuade customers to open a bank account [18]. The results of this research showed that 50% of the increase accounts of a bank is the result followed a promotional campaign. Other researches showed the efficiency of promotion to influence the computer purchase and confirmed the positive linkages, promoting the behavior of purchase of financial services [19, 20].

Recent research on omnichannel shopping based on IT has included the promotion in the research model but has not found a meaningful impact of the promotion on intention to use [21].

In Vietnam, a recent study on the determinants of the choice of the customer mobile wallet, promotion in second place in the six elements outlined in the survey. As emphasized by several authors, there are academic and managerial deficiencies in the profound understanding of the relationship between promotion and consumer behavior [22, 23]. Especially in technology adoption, sales promotion still receives very little attention from researchers. That is why the construct of promotion is added to this study.

H1: The promotion of mobile wallet will positively affect the customers’ perceived usefulness of this technology.

H2: The promotion of mobile wallet will negatively affect the customers’ perceived risk of this technology.

H3: The promotion of mobile wallet will positively affect the social influences of this technology.

H4: The promotion of mobile wallet will positively affect the habit of customers for this technology.

Perceived usefulness

Perceived usefulness was mentioned for the first time by Davis in Technology Acceptance Model (TAM). This term refers to the ability of customers to improve performance by fully using the improved system, reflecting users’ willingness to accept [24].

In technology adoption research, performance expectancy refers to an individual’s perception that using a technology could provide benefits to customers in performing certain activities [25]. Reflecting a range of attributes that a technology could give benefits to clients, performance has been conceptualized by using system features that could enhance speed, productivity, and chances of task accomplishment and perceived usefulness [25, 26]. Unambiguously, in diverse task settings, performance expectancy was affirmed to affect intentions to use technological systems [27]. Consumers’ perception that using mobile wallet would support them to achieve benefits in doing payment tasks could influence the behavioral intention of mobile wallet adoption. The following hypothesis was formulated:

H5: Perceived usefulness will positively affect the user’s intention to use mobile wallet.

Perceived risk

Perceived risk was a popular construct used in extended models of UTAUT2 by several researchers. Perceived risk is considered negatively affect on intention to use [8]. Featherman and Pavlou also posited that individual’s perceived risk of using a technology has negative influence on perceived usefulness (equivalent to performance expectancy) and behavioral intention toward that technology while his or her perceived ease of use (equivalent to effort expectancy) also has an adverse impact on the perceived risk [28]. Since mobile wallet is a new technology and includes complex and sensitive private information, perceived risks could be a difficulty in adopting this technology. Consumers could face monetary loss because of their improper operating system inaccuracy or potential fraud. As a result, their non-refundable paying money would be sent to wrong receivers or scammers or just be disappeared.

Perceived risk diminishes user’s readiness and acceptance of new technology to more security dangers of technology like mobile wallets [7]. Perceived risk could make customers underestimate about the perceived usefulness of a technology and deny accepting it [29]. Some researches showed that perceived risk positively affect on user’s intention ([30]; [31]). Two studies in 2015 further explored factors such as social influence, perceived risk and stressed their important role in mobile payment adoption [32, 33]. The following hypotheses were developed:

H6: Perceived risk will negatively affect the intention to use mobile wallet.

Social influence

Social influence is defined as the degree to which an individual perceives that essential referents such as family and friends believe he or she should adopt a specific technology [25].

Recently, in mobile payment adoption, many researches integrated social influences into their research frameworks and obtained some empirical support [34, 35, 36]. A study of Chong et al. (2010) showed that a customer considers the thoughts of their friends and their family before choosing a new technology [37]. If views of others are not favourable, they will resist adopting that technology. Social influence is also found as the most dominant on user’s behavioural intention in mobile payments [38]. Based on the arguments above, the following hypothesis was developed:

H7: Social influences will positively affect the intention to use mobile wallet.

Habit

Habit is defined as the degree to which an individual performs behaviors automatically because of learning from prior experiences [25, 39]. The effects of habit on both behavioral intention and actual usage behavior have been proposed and validated by researchers [40, 41].

With the current development of mobile commerce, consumers are using mobile devices like smartphones for almost daily tasks such as internet surfing, social connecting, text and voice chatting, video calling, gaming, shopping, bill paying. Therefore, that development could make mobile-related habits relatively more relevant than before toward the influence on both behavioral intention and actual usage behavior of mobile payment. According to Venkatesh et al. (2012) the role of habits in technology use describes the various fundamental processes that affect technology use. In this study, habit is considered being a familiar behavior or an automatic behavior in using mobile wallets. The following proposition was developed:

H8: Habit will positively affect the user’s intention to use mobile wallet.

Intention to use

According to Davis, behavioral intention is considered as the degree to which an individual believes that they will implement a particular behavior [42]. In technology adoption theories, the relationship between behavioral intention and usage behavior has been consistently confirmed [25, 26, 27, 43, 44]. In mobile payment context, there is still a gap between intention and actual use toward the technology. Although the development of mobile commerce has led consumers to use mobile devices in various aspects of their daily lives, the actual amount of mobile payment is still small compared to other forms of payment. Under the technological adoption literature, it can be hypothesized that:

H9: Promotion will positively affect the user’s intention to use mobile wallet.

2.2. Research framework

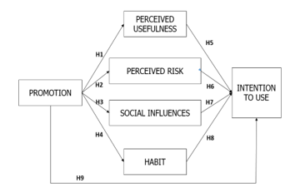

Considered the relationships extracted by hypotheses from previous studies, Figure 1 shows the proposed research model. We included perceived usefulness, social norms, habit; integrated them with perceived risk and a novel construct named promotion. Intention to use and frequency of use applied to measure using behavior.

Figure 1: Conceptual framework (Source: own elaboration)

We proposed this research framework because predicting consumer’s behavioural adoption and usage should be evaluated from a variety of perspectives. This integrated model can help us have a better recognition of the relationships between these research constructs. These relations are already confirmed in the literature review of previous researches, and the validity of model is confirmed in similar studies except the promotion factor that we added in this study [45, 46, 47]. This proposed model has showed relationship among factors affecting using mobile wallet in Vietnam so that previous studies have not focused on evaluating it.

3. Materials and Methods

Authors have used secondary data from previous studies to construct the proposed research model. We used a survey method with a questionnaire based on the 5-Point Likert Scale to test our research model and developed hypotheses. The potential participants of this research were chosen in convenience sampling method from Da Nang City. 400 young people in Da Nang were contacted by e-mail and social network during the period from January 2020 to April 2020. A link to the survey was included in the messages. 315 valid responses were received. The overall response rate was 78.75%.

3.1. Measurement instrument

The research had seven constructs: perceived risk, social influence, perceived usefulness, habit, promotion, intention to use. Constructs and measurement items in this research were modified from previous works on technology acceptance. Measurement items for constructs of perceived usefulness, social influence, perceived risk, habit were altered from Venkatesh et al. (2012). The scale of intention to use was employed from Davis (1989). All measurement items were measured on a five-point Likert scale, ranging from totally disagree (1) to totally agree (5). The frequency of use measurement was operationalized by one item that measure consumers’ actual frequencies of mobile wallet usage.

3.2. Analytical procedures

First, we tested the scales by the Cronbach’s alpha, the exploratory factor analysis (EFA) and the confirmatory factor analysis (CFA). In the next stage, we used the Structural Equation Modeling (SEM) method to evaluate the structural relationships between constructs in the theoretical model.

4. Results and Discussion

4.1. Reliability and validity

The reliability and validity of the constructs in the research were evaluated with SPSS 23. We use Cronbach’s Alpha reliability test because it is a widely used measure that examines the scale reliability [48]. By measuring the reliability coefficient, the reliability test could assess the consistency of the entire scale. Baron & Kenny (1986) suggested that a scale would be high reliable level if the coefficient alpha is greater than 0.7 while the coefficient alpha is higher than 0.6 means the scale is reliable [49]. Table 2 showed that Cronbach’s Alpha of all constructs are above the threshold of 0.7, satisfied internal consistency. All items kept will be included in the analysis Exploratory Factor Analysis (EFA). We used this technique to minimize and summarize data and it is very useful for identifying groups of variables. The relationship of mutually correlated groups of variables consider as several basic factors. Each observed variable will be calculated with a Factor Loading factor, which shows which factor each measurement variable belongs to. The KMO (Kaiser-Meyer-Olkin) coefficient must reach 0.5 or higher, showing that factor analysis is appropriate (0.5 ≤ KMO ≤ 1) [48]. The result of KMO coefficient of the study = 0.889 satisfied the requirements. In addition, Barlett’s test is statistically significant (sig = 0.000 < 0.05) proving that the observed variables correlate with each other in the whole [50]. The results of the EFA analysis yielded results consistent with the structure of the six construct. Therefore, all constructs of this model ensure reliability and convergent validity. These constructs would be used in further analysis to test the proposed hypotheses.

In [51], the author recommended that CFA is rigorous to test the overall measurement model and to assess the reliability and validity of the constructs. We measure convergent validity by using composite reliability (CR) and average variance explained (AVE). By the rule of thumb, CR should be above 0.6 and AVE should be above 0.5 for all constructs. As the results shown in Table 1, CRs of all constructs ranges from 0.723 to 0.898 while the AVEs vary from 0.573 to 0.746. These results confirm that our model meets the requirement for convergent validity.

We used the procedure suggested by [52] to check discriminant validity. From this perspective, the AVE for each of the research constructs should be greater than the squared correlation between the construct and other construct. The Table 2 showed the measurement model satisfy the requirement for discriminant validity. The results indicated that the various AVE are lower than the diagonal variables suggesting all the constructs in this study have satisfactory discriminant validity.

Table 3 showed that the CFA model with six concepts also shows a good fit with the data. All the indices satisfied the recommended cut-off point. We conclude that the model fits data well, so this model can be used to test the research hypotheses.

Table 1: Reliability and validity of the tested model

| Latent constructs | Cronbach’s alpha | CR | AVE | MSV | FL range |

| SI | 0.755 | 0.723 | 0.573 | 0.234 | 0.503-0.910 |

| PR | 0.897 | 0.898 | 0.746 | 0.021 | 0.810-0.905 |

| PU | 0.875 | 0.883 | 0.716 | 0.413 | 0.775-0.874 |

| HB | 0.866 | 0.870 | 0.771 | 0.196 | 0.836-0.909 |

| PM | 0.857 | 0.856 | 0.664 | 0.473 | 0.743-0.850 |

| IU | 0.891 | 0.892 | 0.674 | 0.473 | 0.692-0.917 |

Table 2: Factor correlation coefficients

| AVE | IU | PR | PU | PM | SI | HB | |

| IU | 0.573 | 0.821 | |||||

| PR | 0.746 | -0.143* | 0.864 | ||||

| PU | 0.716 | 0.642*** | -0.086 | 0.846 | |||

| PM | 0.771 | 0.688*** | 0.005 | 0.589*** | 0.815 | ||

| SI | 0.664 | 0.484*** | -0.019 | 0.422*** | 0.472*** | 0.757 | |

| HB | 0.674 | 0.443*** | -0.116† | 0.280*** | 0.312*** | 0.396*** | 0.878 |

Significance of Correlations: (The square root of AVE shown as bold at diagonal)

† p < 0.100, * p < 0.050, ** p < 0.010, *** p < 0.001

Table 3: Indices fit criteria

| Fit indices | Measurement Model | Structural Model | Threshold limit value | Sources |

| CMIN/df | 1.749 | 2.221 | < 5 | [53] |

| CFI | 0.975 | 0.953 | > .90 | |

| GFI | 0.937 | 0.912 | > .90 | [48] |

| AGFI | 0.907 | 0.877 | > .80 | [54] |

| RMSEA | 0.049 | 0.062 | < .08 |

Table 4: Results of the hypothesis testing from the structural model

| H# | Paths | β | S.E. | C.R. | P-value | Conclusion | ||

| H1 | PM | à | PU | .722 | .075 | 9.635 | *** | Supported |

| H2 | PM | à | PR | -.016 | .086 | -.186 | .853 | Rejected |

| H3 | PM | à | SI | .387 | .081 | 4.800 | *** | Supported |

| H4 | PM | à | HB | .380 | .084 | 4.534 | *** | Supported |

| H5 | PU | à | IU | .282 | .055 | 5.124 | *** | Supported |

| H6 | PR | à | IU | -.079 | .035 | -2.255 | .024 | Supported |

| H7 | SI | à | IU | .097 | .071 | 1.361 | .174 | Rejected |

| H8 | HB | à | IU | .153 | .042 | 3.602 | *** | Supported |

| H9 | PM | à | IU | .447 | .080 | 5.556 | *** | Supported |

Table 5: Results of evaluation of indirect effects

| Indirect effects | Estimate | Lower | Upper | P | Conclusion |

| PM to PU to IU | .204 | .119 | .325 | .000 | Supported |

| PM to SI to IU | .038 | -.010 | .113 | .194 | Rejected |

| PM to PR to IU | .001 | -.014 | .023 | .866 | Rejected |

| PM to HB to IU | .058 | .026 | .106 | .002 | Supported |

Evaluation of direct effects

After assessing reliability and validity of the measurement constructs, in this section we will test the research hypotheses based on review of literature and the framework of research model. To conclude, the significance of each hypothesis, S.E (standardized estimates) and p-value was assessed using SEM (structural equation modelling). As showed in the Table 4, seven of nine hypotheses were accepted.

The results in Table 5 showed that the direct path from PM to IU was significantly mediated by PU and HB. As discussed above, as PU and HB were found to have significant direct effects on intention to use the mobile wallet, the mediating effects of SI and PR in the relationship between PM and IU were partial in this study.

Evaluation of predictive capability

In the current study, 60% of the variance in intention to use mobile wallet was explained by five factors: PM, PU, SI, PR and HB. The R2 values of intention to use in this attain a moderate level of predictive accuracy [55]. Hence, the predictive accuracy of the research model was satisfied. Comparing with the model not integrated the construct promotion, we found the R2 value was only 51%. This result showed that promotion is an important factor when researching technology adoption significantly because it improves the level of intentional interpretation of the research model.

4.2. Discussion

In this study, we integrated and explored the promotional factor on users’ intentions of mobile wallet. This is an extra factor and thus we have built 3 items to measure the effect of this factor. We combined with other constructs: social influence, perceived risk, perceived usefulness, habit and promotion to measure consumer’s perception. The research model was successfully predicting a large variance in intention to use mobile wallet (60%). These results indicate the effectiveness of various constructs of this research model.

Taken as a whole, results show that promotion may affect intention to use and suitable for the study hypothesis. Seven hypotheses were accepted and two hypotheses were rejected (H2 and H7).

PM impact positively to PU

This is the first study to confirm the direct impact of PM on PU. This result also confirms the separation of PM and PU when in many studies that PU also implies the benefits from service use. Indeed, in the current fierce competition context, the perceived benefits measured by traditional items have become almost inevitable. PU-free technologies from customers will almost certainly be rejected. Therefore, PU is almost a must for all companies who want to enter the market need to prove the advantages of their products. However, in order for customers to choose their products, companies need to have appropriate PM strategies, ensuring long-term maintenance, avoiding batches, and ensuring financial efficiency. Implementing the above will ensure mobile wallet providers a long-term competitive advantage in an extremely fierce market with more than 30 mobile wallet providers like in Vietnam.

PM impact positively to SI

This result is also the first time that PM has been shown to have a direct effect on SI. Indeed, when there are attractive promotions, customers will recommend more mobile wallets to acquaintances because they believe that acquaintances will need to use and will bring similar positive experiences. as they experienced. PM has a strong impact on SI and thus mobile wallet providers can take advantage of this factor to offer promotions that can take advantage of even social influences such as referrals to acquaintances who will receive. attractive promotions, for example vouchers, gifts … Thus, the effectiveness of the promotions in influencing customer behavior in using the mobile wallet will be improved.

PM impact positively to HB

As expected, more promotions will be an important factor in creating habits among users. Therefore, companies need to offer relevant and lasting promotions, striving to maintain the user’s habit as a must-have routine. To do this, providers need to develop and integrate more features into the mobile wallet. Just using the mobile wallet can help users solve many problems in life. All of these will form the usage habits for customers, creating customer loyalty for the mobile wallet. The development of a payment ecosystem to provide a convenient and seamless payment experience for users is seen as a key factor for wallets to retain customers in the long run.

PM don’t have a significant effect on PR

Usually, when faced with a decision like whether or not to use a mobile wallet, customers often compare gains and losses, risks and opportunities.

However, this result contradicts the original assumption that PM will negatively affect perceptions of risk. The promotions also do not reduce the risk perception of customers because in recent times in Vietnam, many new technology applications have relied on customers’ trust and subjectivity to implement the fraudulent behavior like P2P lending applications. Despite being warned, many customers still have serious problems because of the use of these new technologies [56]. Hence the vigilance and precaution of the customer is very high.

PU have a significant and positive impact on IU.

Perceived usefulness in this research has a positive and significant impact on intention to use mobile wallet (β = 0.274; p-value < 0.001). This result is similar with many previous studies which found that perceived usefulness was one of the most important factors to determine intention to use [3, 57, 58]. Usefulness of a new technology is essential to increase intention to use. These studies also used UTAUT2 as their basis model and reinforced the impact of perceived usefulness on using behaviour [5, 8]. However, we found others study in which perceived usefulness is insignificant in the prediction of the user’s intention of mobile wallet services [32].

PR have significant and negative impact on IU

PR has negative and significant effects on IU. In fact, security is always a major worry for the customer while performing payments via mobile wallet [3]. Public sharing of personal information, private information leaks while doing transactions with mobile wallet are the most common concerns [59]. In contrast, we have several studies in literature revealed the positive relationship between perceived risk and intention to use [31, 60]. Marketing strategies that reach target customers must show customers that there are no risks involved in using mobile wallet. This would lessen perceived risk of customers and therefore improve their intention to use mobile wallet. A risk-free environment once created would result in a greater intention to use a mobile wallet app.

SI don’t have a significant effect on IU

SI in the current research does not show a significant impact on IU. It is contrast with results of previous studies which confirmed that friends, family and relatives significantly influence the user’s intention [8, 25, 33].

HB have a significant and positive impact on IU

HB was accepted in this research as a significant factor influencing intention to use mobile wallet. This result supports the perspective of Venkatesh et al (2012) who confirmed HB as a critical predictor of customer intention. Take into consideration, the mobile wallet providers need to make an effort in creating the condition where mobile wallet becomes a habit with consumers. For example, they can integrate the e-commerce ecosystem in using the mobile wallet as a payment method or think about give cashback promotion for payment in the retail market. This effort would generate a habit for the consumer to use a mobile wallet more frequent for daily life.

PM have significant and positive impact on IU

Among the constructs in the model which have a direct relationship with IU, PM was shown to have the strongest impact to IU (β = 0.439; p-value < 0.001). In a survey conducted in major cities in Vietnam about the key factors influencing consumers’ choice of mobile wallets, diverse and regular promotions were assessed as one of the deciding factors to choose a mobile wallet. In fact, many people used a technology for the first time because of attractive promotions. As mentioned in the first part of this paper, this is a factor that has received little attention from academics when studying the consumer adoption of new technology. However, as showed in the results, mobile wallets’ suppliers need to have many attractive promotions to gain consumer acceptance. Compared to other platforms, mobile wallets do not have many attractive promotions and that may be the reason that mobile wallets are still not popular in the Vietnamese market.

From practical perspectives, the results of this study provide empirical evidence on critical factors to be considered by not only suppliers but also marketers of the mobile wallet. It reveals that promotion and usefulness of use of mobile wallets are the most important factors in user adoption. These factors will improve intention of use of a mobile wallet. To get users to use a mobile wallet, application developers must emphasize the benefits of usefulness and attractive promotion related with this new financial service.

5. Conclusions and limitations

This study is successful in providing an integrated research model for academics to test the impact of social, psychological, and risk factors on technology adoption. In addition, it also helps companies providing mobile wallet services by identifying key factors that influence users’ decisions and helping them to have the most comprehensive view of customers. Using SEM analysis, 7 of 9 hypothesis research were accepted. Results of this research are found significant and coherent with previous works on mobile payment and mobile wallet.

This research model explains 60% of intention to use mobile wallet in Vietnam, whereas the same model but without construct promotion explained only 50% in the variation in intention to use mobile wallet. This result demonstrated that putting the new promotion variable to the research model of the adoption and use of technology is necessary and that makes the theoretical contribution of the current study. This is also the premise for future researches when studying the adoption of technology, researchers could integrate promotion to the model to achieve a significant improvement in the level of interpretation as showed in this study.

Last but not least, in this study, we proposed the scale used to measure promotion based on the literature, expert panel and interviews with focus group. The items in this scale will provide the foundation for further research concerning technology adoption such as mobile wallet.

Beside of our study’s major contribution that adds into the existing body of knowledge, we also recognize its limitations, mostly regarding the sampling with typically young, highly educated people as responders. In addition, our results have limitation regarding the specific context of Danang city. Danang is an average city with a relatively limited market as its population is approximately one million people. This sample only covers with young people in this city. In order to further enhance its generality, future research could extend the study to more cities or conduct in more countries in Southeast Asia to improve the generalization of the study. Although this research contributes more empirical results in this area, it also has some limitations and therefore further studies in this area will be needed.

Conflict of Interest

There is no conflict of interest regarding this study.

Acknowledgment

This study involves no supporting grants.

- PricewaterhouseCoopers, Mobile payments in Vietnam fastest growing globally, Thailand emerges second in Southeast Asia, PwC, Nov. 2020.

- H. Ha, “The Cashless Economy in Vietnam-The Situation and Policy Implications,” Journal of Reviews on Global Economics, 9, 216-223, 2020. doi: 10.6000/1929-7092.2020.09.20.

- K. Madan, R. Yadav, “Behavioural intention to adopt mobile wallet: a developing country perspective,” Journal of Indian Business Research, 2016, doi: 10.1108/JIBR-10-2015-0112.

- B. An, (2020). The ecosystem makes a breakthrough for electronic wallets Press release.

- A.A. Alalwan, Y.K. Dwivedi, N.P. Rana, “Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust,” International Journal of Information Management, 37(3), 99–110, 2017, doi: 10.1016/j.ijinfomgt.2017.01.002

- D.-H. Shin, “Towards an understanding of the consumer acceptance of mobile wallet,” Computers in Human Behavior, 25(6), 1343-1354, 2009, doi:10.1016/j.chb.2009.06.001.

- P.G. Schierz, O. Schilke, B.W. Wirtz, “Understanding consumer acceptance of mobile payment services: An empirical analysis,” Electronic Commerce Research and Applications, 9(3), 209–216, 2010, doi: 10.1016/j.elerap.2009.07.005.

- R. Thakur, M. Srivastava, “Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India,” Internet Research, 2014, doi:10.1108/IntR-12-2012-0244.

- Kapoor, K. K., Dwivedi, Y. K., & Williams, M. D., “Examining the role of three sets of innovation attributes for determining adoption of the interbank mobile payment service,” Information Systems Frontiers, 17(5), 1039-1056, 2015, doi: 10.1007/s10796-014-9484-7.

- J. Dubey, “Personal care products: Sales promotion and brand loyalty,” Journal Of Contemporary Management Research, 8(1), 52, 2014.

- J.B. Yusuf, “Ethical implications of sales promotion in Ghana: Islamic perspective,” Journal of Islamic Marketing, 2010, doi:10.1108/17590831011082400.

- F. de O. Santini, C.H. Sampaio, M.G. Perin, V.A. Vieira, “An analysis of the influence of discount sales promotion in consumer buying intent and the moderating effects of attractiveness,” Revista de Administração (São Paulo), 50(4), 416–431, 2015, doi:10.5700/rausp1210.

- S. Mussol, P. Aurier, G.S. de Lanauze, “Developing in-store brand strategies and relational expression through sales promotions,” Journal of Retailing and Consumer Services, 47, 241–250, 2019, doi: 10.1016/j.jretconser.2018.11.020.

- A. Mughal, A. Mehmood, A. Mohiuddeen, B. Ahmad, “The impact of promotional tools on consumer buying behavior: a study from Pakistan,” Journal of Public Administration and Governance, 4(3), 402–414, 2014, doi: 10.5296/jpag.v4i3.6680.

- P. Chandon, B. Wansink, G. Laurent, “A benefit congruency framework of sales promotion effectiveness,” Journal of Marketing, 64(4), 65–81, 2000, doi: 10.1509/jmkg.64.4.65.18071.

- J.Y. Kim, B.P. Min, “Comparison of effectiveness between various sales promotions,” Korean Management Review, 34(2), 445–469, 2005.

- M. Palazon, E. Delgado-Ballester, “Effectiveness of price discounts and premium promotions,” Psychology & Marketing, 26(12), 1108–1129, 2009, doi: 10.1002/mar.20315.

- R.H. Preston, F.R. Dwyer, W. Rudelius, “The Effectiveness of Bank Premiums: Stoneware… calculators… and Mercedes Sport Coupes–do they pay their way?,” Journal of Marketing, 42(3), 96–101, 1978, doi: 10.1177/002224297804200317.

- A. d’Astous, I. Jacob, “Understanding consumer reactions to premium-based promotional offers,” European Journal of Marketing, 2002, doi: 10.1108/03090560210445173.

- R.B. Boschetti, Promoção de vendas não monetária e seus efeitos na intenção de compra e na escolha da marca de serviços financeiros, Pontifícia Universidade Católica do Rio Grande do Sul, 2012.

- Y. Lee, H. Cheon, “A Study on the Factors Affecting the User Intention of Omnichannel Shopping Based on Information Technology,” in Proceedings of the 2019 5th International Conference on E-Business and Applications, 20–24, 2019, doi: 10.1145/3317614.3317623.

- A. d’Astous, V. Landreville, “An experimental investigation of factors affecting consumers’ perceptions of sales promotions,” European Journal of Marketing, 2003, doi: 10.1108/03090560310495447.

- H. Haans, E. Gijsbrechts, “‘One-deal-fits-all?’ On category sales promotion effectiveness in smaller versus larger supermarkets,” Journal of Retailing, 87(4), 427–443, 2011, doi: 10.1016/j.jretai.2011.05.001.

- F.D. Davis, R.P. Bagozzi, P.R. Warshaw, “User Acceptance of Computer Technology: A Comparison of Two Theoretical Models,” Management Science, 35(8), 982–1003, 1989, doi:10.1287/mnsc.35.8.982.

- Venkatesh, Thong, Xu, “Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology,” MIS Quarterly, 36(1), 157, 2012, doi:10.2307/41410412.

- Venkatesh, Morris, Davis, Davis, “User Acceptance of Information Technology: Toward a Unified View,” MIS Quarterly, 27(3), 425, 2003, doi:10.2307/30036540.

- G. Baptista, T. Oliveira, “Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators,” Computers in Human Behavior, 50, 418–430, 2015, doi:10.1016/j.chb.2015.04.024.

- M.S. Featherman, P.A. Pavlou, “Predicting e-services adoption: a perceived risk facets perspective,” International Journal of Human-Computer Studies, 59(4), 451–474, 2003, doi: 10.1016/S1071-5819(03)00111-3.

- E. Swilley, “Technology rejection: the case of the wallet phone,” Journal of Consumer Marketing, 27(4), 304–312, 2010, doi:10.1108/07363761011052341.

- H. Lee, Y. Lee, D. Yoo, “The determinants of perceived service quality and its relationship with satisfaction,” Journal of Services Marketing, 2000, doi: 10.1108/08876040010327220.

- J.-H. Wu, S.-C. Wang, “What drives mobile commerce?,” Information & Management, 42(5), 719–729, 2005, doi:10.1016/j.im.2004.07.001.

- E.L. Slade, Y.K. Dwivedi, N.C. Piercy, M.D. Williams, “Modeling consumers’ adoption intentions of remote mobile payments in the United Kingdom: extending UTAUT with innovativeness, risk, and trust, ” Psychology & Marketing, 32(8), 860-873, 2015, doi:10.1002/mar.20823.

- Y. Yang, Y. Liu, H. Li, B. Yu, “Understanding perceived risks in mobile payment acceptance,” Industrial Management & Data Systems, 2015, doi:10.1108/IMDS-08-2014-0243.

- J.-C. Gu, S.-C. Lee, Y.-H. Suh, “Determinants of behavioral intention to mobile banking,” Expert Systems with Applications, 36(9), 11605–11616, 2009, doi:10.1016/j.eswa.2009.03.024.

- U. Tandon, R. Kiran, A.N. Sah, “Understanding Online Shopping Adoption in India: Unified Theory of Acceptance and Use of Technology 2 (UTAUT2) With Perceived Risk Application,” Service Science, 8(4), 420–437, 2016, doi:10.1287/serv.2016.0154.

- P. Duarte, S. Costa e Silva, M.B. Ferreira, “How convenient is it? Delivering online shopping convenience to enhance customer satisfaction and encourage e-WOM,” Journal of Retailing and Consumer Services, 44, 161–169, 2018, doi:10.1016/j.jretconser.2018.06.007.

- A.Y.L. Chong, N. Darmawan, K.B. Ooi, B. Lin, “Adoption of 3G services among Malaysian consumers: an empirical analysis,” International Journal of Mobile Communications, 8(2), 129, 2010, doi:10.1504/IJMC.2010.031444.

- G.W.-H. Tan, K.-B. Ooi, “Gender and age: Do they really moderate mobile tourism shopping behavior?,” Telematics and Informatics, 35(6), 1617–1642, 2018, doi:10.1016/j.tele.2018.04.009.

- Limayem, Hirt, Cheung, “How Habit Limits the Predictive Power of Intention: The Case of Information Systems Continuance,” MIS Quarterly, 31(4), 705, 2007, doi:10.2307/25148817.

- Pavlou, Fygenson, “Understanding and Predicting Electronic Commerce Adoption: An Extension of the Theory of Planned Behavior,” MIS Quarterly, 30(1), 115, 2006, doi:10.2307/25148720.

- N.K. Lankton, E.V. Wilson, E. Mao, “Antecedents and determinants of information technology habit,” Information & Management, 47(5), 300–307, 2010, doi:10.1016/j.im.2010.06.004.

- F. D. Davis, A technology acceptance model for empirically testing new end-user information systems: Theory and results, Ph. D Thesis, Massachusetts Institute of Technology, 1985.

- F.D. Davis, R.P. Bagozzi, P.R. Warshaw, “User Acceptance of Computer Technology: A Comparison of Two Theoretical Models,” Management Science, 35(8), 982–1003, 1989, doi:10.1287/mnsc.35.8.982.

- V. Venkatesh, F.D. Davis, “A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies,” Management Science, 46(2), 186–204, 2000, doi:10.1287/mnsc.46.2.186.11926.

- C. Kim, M. Mirusmonov, I. Lee, “An empirical examination of factors influencing the intention to use mobile payment,” Computers in Human Behavior, 26(3), 310–322, 2010, doi: 10.1016/j.chb.2009.10.013.

- F. Liébana-Cabanillas, V. Marinković, Z. Kalinić, “A SEM-neural network approach for predicting antecedents of m-commerce acceptance,” International Journal of Information Management, 37(2), 14–24, 2017, doi:10.1016/j.ijinfomgt.2016.10.008.

- N. Shaw, “The mediating influence of trust in the adoption of the mobile wallet,” Journal of Retailing and Consumer Services, 21(4), 449–459, 2014, doi:10.1016/j.jretconser.2014.03.008.

- J.F. Hair, W.C. Black, B.J. Babin, R.E. Anderson, R.L. Tatham, Multivariate data analysis, Prentice hall Upper Saddle River, NJ, 2006.

- R.M. Baron, D.A. Kenny, “The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations.,” Journal of Personality and Social Psychology, 51(6), 1173–1182, 1986, doi:10.1037/0022-3514.51.6.1173.

- M.S. Bartlett, “A Note on the Multiplying Factors for Various χ 2 Approximations,” Journal of the Royal Statistical Society: Series B (Methodological), 16(2), 296–298, 1954, doi:10.1111/j.2517-6161.1954.tb00174.x.

- M.S. Garver, J.T. Mentzer, “Logistics research methods: employing structural equation modeling to test for construct validity,” Journal of Business Logistics, 20(1), 33, 1999.

- C. Fornell, D.F. Larcker, “Evaluating structural equation models with unobservable variables and measurement error,” Journal of Marketing Research, 18(1), 39–50, 1981, doi: 10.2307/3151312.

- P.M. Bentler, P. Dudgeon, “COVARIANCE STRUCTURE ANALYSIS: Statistical Practice, Theory, and Directions,” Annual Review of Psychology, 47(1), 563–592, 1996, doi:10.1146/annurev.psych.47.1.563.

- L. Hu, P.M. Bentler, “Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives,” Structural Equation Modeling: A Multidisciplinary Journal, 6(1), 1–55, 1999, doi:10.1080/10705519909540118.

- J. Henseler, C.M. Ringle, R.R. Sinkovics, The use of partial least squares path modeling in international marketing, Emerald Group Publishing Limited, 2009.

- T.D. Uyen, H. Ha, “The sharing economy and collaborative finance: The case of P2P lending in Vietnam,” Jurnal Ilmiah Ekonomi Bisnis, 22(2), 2017.

- F. Liébana-Cabanillas, J. Sánchez-Fernández, F. Muñoz-Leiva, “Antecedents of the adoption of the new mobile payment systems: The moderating effect of age,” Computers in Human Behavior, 35, 464–478, 2014, doi:10.1016/j.chb.2014.03.022.

- I.R. de Luna, F. Liébana-Cabanillas, J. Sánchez-Fernández, F. Muñoz-Leiva, “Mobile payment is not all the same: The adoption of mobile payment systems depending on the technology applied,” Technological Forecasting and Social Change, 146, 931–944, 2019, doi:10.1016/j.techfore.2018.09.018.

- A. Hossain, R. Quaresma, H. Rahman, “Investigating factors influencing the physicians’ adoption of electronic health record (EHR) in healthcare system of Bangladesh: An empirical study,” International Journal of Information Management, 44, 76–87, 2019, doi:10.1016/j.ijinfomgt.2018.09.016.

- Y.-Y. Wang, Y.-S. Wang, T.-C. Lin, “Developing and validating a technology upgrade model,” International Journal of Information Management, 38(1), 7–26, 2018, doi:10.1016/j.ijinfomgt.2017.07.003.

- Yakob Utama Chandra, Bahtiar Saleh Abbas, Agung Trisetyarso, Wayan Suparta, Chul-Ho Kang, "Comparison Analysis between Mobile Banking and Mobile Payment as Determinant Factors of Customer Privacy", Advances in Science, Technology and Engineering Systems Journal, vol. 5, no. 2, pp. 469–475, 2020. doi: 10.25046/aj050260

- Riyan Rizkyandy, Djoko Budiyanto Setyohadi, Suyoto, "What Should Be Considered for Acceptance Mobile Payment: An Investigation of the Factors Affecting of the Intention to Use System Services T-Cash", Advances in Science, Technology and Engineering Systems Journal, vol. 3, no. 2, pp. 257–262, 2018. doi: 10.25046/aj030230