Criteria to Implement a Supervision System in the Petroleum Industry: A Case Study in a Terminal Storage Facility

Volume 5, Issue 5, Page No 29-38, 2020

Author’s Name: Khalid Chkaraa), Hamid Seghiouer

View Affiliations

Laboratory MOSIL, National School of Applied Sciences, University Abdelmalek Essaâdi, Tétouan, 93000, Morocco

a)Author to whom correspondence should be addressed. E-mail: k.chkara@gmail.com

Adv. Sci. Technol. Eng. Syst. J. 5(5), 29-38 (2020); ![]() DOI: 10.25046/aj050505

DOI: 10.25046/aj050505

Keywords: Petroleum storage terminal, Supervision system, DCS, SCADA, Project management, Oil & Gas

Export Citations

A liquid petroleum storage facility (Terminal), is a platform used to store petroleum products. Terminals plays a strategic role on the oil and gas supply chain. There are three types of terminals: a fully automated terminal, a partially automated terminal and a fully manual terminal. To increase their efficiency and safety in a very competitive market, terminal companies might take the decision to invest in a supervisory control system DCS or SCADA. The advantages of DCS/SCADA systems are: improving the productivity and the proactivity, reducing cost, identifying quickly abnormal operating conditions and finally enhancing the efficiency and the safety. Due to the high cost of this project type, it is deemed vital to take the right decision when comparing the different options. The automation market offers multiple choices and opportunities, and taking the correct decision is a very challenging process. The key criteria for the technical evaluation are: 1) service offered, 2) interface capabilities,3) tender process efficiency and project execution, 4) after sales and product life cycle,5) references and finally 6) additional services. In this paper, the importance of each key criterion is identified and measured, leading to the development of a tool to be used for the assessment of different offers in order to successfully implement a supervision system. It consists of a framework based on a past experience of subject matter expert for a real case related to a successful implementation of a DCS system on a liquid petroleum storage facility. The paper provides as well a valuable feedback for vendors and can be used as a reference when preparing their commercial and technical strategy for future projects.

Received: 16 June 2020, Accepted: 11 August 2020, Published Online: 08 September 2020

1. Introduction

The downstream petroleum supply chain (PSC) represents a major economic sector that ensure production, storage and handling of petroleum products in a cost-efficient and safely manner [1].

Liquid petroleum storage facilities play a key role on this supply chain. They are an essential player to import or to export crude or refined products in a given country.

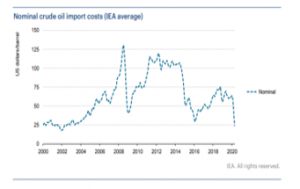

Over the past few years, the global logistics and oil market is transforming rapidly and its complexity compounded by the volatility of petroleum product pricing due to the effect of crude oil price globally (Figure 1) [2,3].

Such volatile and contango crude oil market have driven the traders and even oil majors/producers to use strategic storage facilities for futures trading and consolidation of crude oil and refined petroleum products [4].

Terminal storage facilities are also part of the trading business where petroleum product is stored and transshipped depending on the market evolution. There are two types of terminal operators:

- Terminal operators who own the asset as well as the product which is stored in. Typically, major oil compagnies fall under this category;

- Terminal operators who do not own the product and they are considered as independent storage companies. Their business model is based on providing storage space and handling services for their customers.

Figure 1: Average crude oil import costs [3]

Petroleum storage facility may store different types of bulk liquid: chemical, refined/semi-refined products, crude oil and LNG. The design of the terminal varies depending on the substances to be stored.

Terminal operations are present worldwide; however, storage hubs have become established in the United States, Europe, Middle East and Asia to provide the necessary storage and handling services required for the international trade of petroleum products.

The tank storage sector is not a static industry but a dynamic one which grows every year.

Estimates are that global tank storage capacity will grow 8% to 1.03 billion cbm in 2020 and even 11.5% to 1.06 billion cbm in 2021 [5].

In Figure 2 can be seen where the largest concentrations of tank terminals are [6].

Figure 2: The world’s hottest storage hotspots

Europe provides approximately 30% of the world capacity for bulk liquid storage through a network of hundreds of terminals providing logistical support for industry, authorities and the armed forces. In principle any liquid product that is transported in bulk can be stored in a bulk liquid terminal [7].

Until recent times, refineries as well as terminal storage facilities structures have been fairly static and scarcely investigated due to the lack of detailed information and low market competition. However, nowadays competition has significantly increased and is currently driving the global petroleum supply chain including storage facilities to review the design with a strong focus on automated processes and decision-making effectiveness [8], this can be achieved by implementing a robust supervision system.

The key issue is to clearly define the criteria to compare the exiting solutions. Although some of the works focused on the technical specification of implementing a DCS/SCADA system as well as operation and control techniques [9], only a limited number of works have addressed the qualitative approach to solve the issue, which constitutes a research field with high potential from the project management perspective. In this paper we extend and refine the work of [10] who provide new technological developments and selection criteria of industrial Scada applications. Our work updates the earlier work by considering a qualitative and quantitative methodology to define key criteria and to introduce a decision-making tool to support help Project Managers during the technical evaluation and assessment process.

2. The liquid petroleum storage facility description

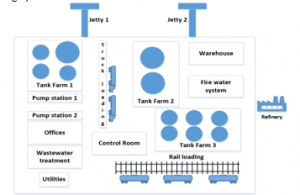

A liquid petroleum storage facility provides a vital interface between sea, road, rail and piping systems. A typical terminal is usually located nearby a port area and equipped with different asset to allow efficient and safe handling and storage services (see Fig.3).

Figure 3: Various parts of a terminal

Those assets are but not limited to:

Marine Berth or deck: usually located in a port, it is used for mooring ship alongside. It provides a safe area where ships can be safely moored to proceed with loading or unloading operations. There are two types of berths: solid structure births or open structure births.

Tank farm: a group of tanks where products are stored, the design of the tank varies in function of the specification of the product to be stored [11], tanks might be fixed roof, floating roof, heated tanks, or insulated tanks.

Piping system: it’s the network where the liquid product moves from the terminal into or from the ship. Pipes are made from different qualities of steel: carbon steel, galvanized or inox. For more flexibility it’s frequent to use hoses mainly for the ship shore connection.

Pumping system: it’s the equipment used to pump the product from the tanks into ships, rail cars or trucks. Pumps come in variety of sizes for a wide range of applications. The most frequent type of pumps used in terminals are: positive displacement and centrifugal.

Truck/rail loading: an asset used to load petroleum products into trucks or rail cars, custody transfer measurement is usually ensured through flowmeters using different technologies such as Coriolis, turbine or positive displacement meters [12]. Also, it’s common to use weighbridge for product where weight is considered for the commercial transactions. Figure 3 shows a flow diagram for typical storage facility

Firefighting system: due the high flammability of the products stored, it’s essential for any terminal to have a robust firefighting system. The task of fire safety ensuring of such assets becomes very important [13]. Firefighting equipment are divided into two categories: fixed and mobile. The terminal should have also access to a reserve of water and a foam to be used in case of emergency or a fire. Design of the fire system is subject to international standard and regulations [14].

Utilities: in a typical terminal, there are different types of utilities to help providing the handling and the storage services, such utilities are: boilers, compressors, drumming equipment, vapor recovery systems, blending system, nitrogen facilities and water/slop treatment plant.

Supervision system: it consists usually on a DCS or SCADA. It is a purely software package that is positioned on top of hardware to which it is interfaced. The main function is to monitor and control different types of field devices through a unique interface. Field devices could be: level gauges, pressures and temperature transmitters, local alarms, flowmeters, energy consumption and metering, equipment running conditions, pumping start and stop command [15].

Table 1: Acronyms in SCADA/DCS systems

| Acronym | Definition |

| DCS | Digital Control System |

| HMI | Human Machine Interface |

| IED | Intelligence Electronic Device |

| MSU | Master Station Unit |

| RTU | Remote Terminal Unit |

| SCADA | Supervisory Control and Data Acquisition |

| SSU | Slave Station Unit |

Supervision system may also provide business solution for some activity like truck/rail loading, shipping loading, material balance and stock reconciliation. Fig.4 represents the general functionality existing on a DCS/SCADA solution [16].

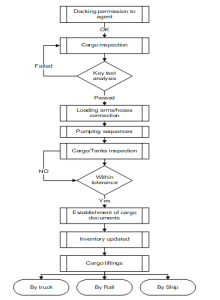

A typical workflow for a petroleum storage facility is from cargo receipt until final delivery is represented on the below flow diagram (See Fig 5).

Figure 4: General configuration of DCS solution

Figure 5: Terminal flow diagram

3. Advantages of implementing a DCS system in a liquid petroleum storage facility

DCSs are used to control industrial processes such as electric power generation, water and wastewater treatment, and chemical, food, and automotive production. DCSs are integrated as a control architecture containing a supervisory level of control overseeing multiple, integrated subsystems that are responsible for controlling the details of a localized process [17].

On the oil and gas, it’s very common to find DCS systems implemented in process plants such as refineries. The DCS system plays a key role to automate an oil refinery and to minimize human intervention and consequently reduce failures. While the Scada monitors the system, the PLC is used for the internal storage of instruction for implementing functions such as logic, sequencing, timing and arithmetic to control different type of process devices using digital and analog input/output module [18].

Although the Petroleum storage facility are typically not considered as process plant, market evolution, customers requirement and best practice in the industry push many terminal operators to invest on supervision system. Analysis of the Distributed Control Systems (DCS) Market in India, finds that the market earned approximately $707.9 million in 2012 and estimates this to reach $1,078.9 million in 2016 [19].

Accurate and real time data acquisition is required for decision making to optimize the efficiency and the safety aspect of any liquid petroleum storage facility. Information and communication technologies are of vital importance to almost all aspects of oil and gas operations, from upstream to downstream business [20]. Combined with advanced process controls, terminal’s operators may use the DCS not only to achieve regulatory and process controls, but to fully utilize its potential as a direct revenue generator contributing to maintain the company’s competitive edge [21].

Another important aspect is safety; because of the dangerous and the valuable nature of the product handled within any terminal, many petroleum storage facilities invest on supervision systems that prevent tragic events from happening by showing exactly where the problem is and by presenting the right information in the right context to the right user. Despite highly equipped process plants’ and storage sites’ considerable efforts towards effective safety measures, it is still possible that an improbable event, or more likely an unforeseen series of events, may lead to a serious incident. In fact, the task of fire safety becomes very important, major incidents on such facilities can have catastrophic consequences both for neighbouring activities and environment [22]. One of the options that supervision systems might offer is the automation of emergency response plan for petroleum oil storage terminals which is an integral and essential part of a loss prevention strategy [23]. A quick review of the ten largest tank accidents between 1963 and 2002 shows that operational error was the third most frequent cause followed by equipment failure [24].

4. Criteria assessment to choose a DCS provider for a liquid petroleum storage facility

4.1. The study’s methodology

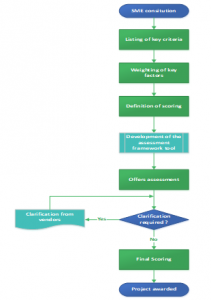

In our approach we have adopted a methodology which consists on the definition and the determination of key factors for the right choice and consequently for a successful implementation of a supervision system on a petroleum storage facility. The definition of the criteria list is a key step on the process, this is the primary input that will be used during the development of the final assessment framework. Our aim is to produce an efficient, tested and reliable tool that can be used in other facilities for similar projects.

Figures 6 shows the flow diagram of the process adopted.

Figure 6: Methodology flowchart

Although this frame work has been tested on a real case study, there is some limitation to be considered:

- Scope of work (SOW): its development might vary from an organization to another; and this could alter the relevance of the proposed framework. As explained below in section b (The assessment process definition), the exiting key criterion should match with the requirement of the scope of work, otherwise there will be non-consistency on the assessment process. Vendors should be aware of the relevance of each criteria and this must be clearly stated on the SOW.

- Weightage of the key criteria: definition of the weightage relies basically on the experience of the subject matter expert (SME) committee members of this specific location, to ensure the consistency of the tool, it’s will be very useful to review the results of the workshop by other SME.

At this stage, the main purpose of our work is to present a framework that might be the ground for a more complex database. This database could be developed in a way to become a rating platform for the vendors to present the advantages of their solutions and their compliance to a specific checklist, a sort of a Label recognized within the Oil & Gas industry.

4.2. The assessment process definition

Investing on a supervision system is a strategic decision of liquid petroleum storage facility. Due to the high cost of the existing solution on the market, it is vital to have a robust assessment system in place to choose the right vendor. Cost is always a key decision factor but not the only one, determining the key aspect on any solution may help to make the right decision. we have followed the process of a successful implementation of a supervision system in a petroleum storage facility. We have built a tool that might be used by other managers to assess the different offers existing at the right cost but without compromising the quality of the product.

It is important to highlight that a clearly defined scope of work will help the later assessment of the offers in a way that vendors will provide similar offers; therefore, comparison between the advantages and disadvantages of each offer will become straight forward.

- The first step consists of listing the key important factor that will be the basis of the assessment. A brainstorming has been conducted with a multidisciplinary team to determine the most important criteria to retain. The scope of work has been used as a reference to identify such criteria;

- The second step includes providing a weighting to each criterion. The weighting varies from 1 to 4 and it defines the relevance of each criterion. It is a sort of hierarchy of the criteria which allows a more accurate assessment of each item. (See table 2);

- The third step entails providing a score to each item depending on the received offers. The score varies from 0 to 3. (See table 2)

Table 2: Definition of scores

| Scoring | Weighting | |

| 0 = not available | 4 = critical | |

| 1 = minimal offering | 3 = must have | |

| 2 = average offering | 2 = nice to have | |

| 3 = excellent offering | 1 = minimal |

4.3. List of the defined criteria

After the workshop with the subject matter experts (SME), a list of the key criteria has been defined and organized by group.

Group 1: Services offered

It covers the different option that the supervision system will provide to meet the needs of the liquid petroleum storage facility such as:

- Holistic Terminal Automation System (TAS);

- General DCS/SCADA functionalities;

- Marine TAS, truck loading TAS;

- Rail loading TAS;

- External pipeline TAS;

- Drumming TAS;

- Utilities & energy management and monitoring TAS.

Group 2: Interfaces capabilities

One of the major challenges that might compromise the success of the supervision system implementation is the capabilities of the solution to communicate with third party software, existing field devices, PLCs and ERPs. List of criteria which fall under this group are:

- Use of common international standards;

- Interfaces with most common L4 ERP systems;

- Interfaces withs most L1 equipment/sensors;

- Interfaces with existing packages.

Group 3: Tender process efficiency and project execution

This group is related to the tender process and project management efficiency. The tender process is a very good opportunity to assess the quality of the provider: response time, site visit, or the respect of the tender deadline date are signs to be considered. Also, the project execution phases and methodology contribute significantly to the success of the implementation. List of criteria which fall under this group are:

- Speed and quality of response;

- Understating of the requirement;

- Factory acceptance test (FAT) testing convenience and facilities;

- FAT testing with integrated with existing equipment;

- Training of operational and maintenance staff;

- Availability of resources during the design phase (in region).

Group 4: After sales and product life cycle

As for any operation technology (OT) Lifecyle and after sales support is considered as important as the implementation itself. One of the disadvantages of a DCS/SCDA solution is the risk of the non-availability of the system due to a breakdown. Shifting from manual operations to automated ones depends highly on the reliability of the solution. Any dysfunction of the system might have major consequences on the business continuity or on the safety of the facility. List of criteria which fall under this group are:

- Availability of remote support 24/7 and its cybersecurity protection;

- Availability of regional or in country support 24/7;

- Size of the support organization;

- Production life cycle duration and software update/upgrade strategy;

- Availability of spare part;

- Provision of support in different languages.

Group 5: Reputation and references

During the amendment of the offers, it is very useful to check the past experience of the providers with similar project, and specially

Table 3: offers comparison using the technical assessment tool

| Supplier 1 | Supplier 2 | Supplier 3 | |||||

| Weighting | Score | max score | Score | max score | Score | max score | |

| 1.Services offered | |||||||

| Holistic Terminal Automation System (TAS) | 4 | 3 | 12 | 3 | 12 | 3 | 12 |

| General DCS/SCADA functionalities | 4 | 3 | 12 | 3 | 12 | 3 | 12 |

| Marine TAS, truck loading TAS, | 4 | 3 | 12 | 3 | 12 | 3 | 12 |

| Rail loading TAS, | 4 | 3 | 12 | 3 | 12 | 3 | 12 |

| External pipeline TAS, | 1 | 2 | 2 | 2 | 2 | 0 | 0 |

| Drumming TAS | 1 | 2 | 2 | 2 | 2 | 0 | 0 |

| Utilities & energy management and monitoring TAS | 4 | 3 | 12 | 3 | 12 | 3 | 12 |

| Sub-score 1 | 64 | 64 | 60 | ||||

| % | 97% | 97% | 91% | ||||

| 2.Interfaces capabilities | |||||||

| Use of common international standards | 4 | 3 | 12 | 3 | 12 | 3 | 12 |

| Interfaces with most common L4 ERP systems | 3 | 3 | 9 | 3 | 9 | 3 | 9 |

| Interfaces withs most L1 equipment/sensors | 3 | 3 | 9 | 3 | 9 | 3 | 9 |

| Interfaces with existing packages | 4 | 2 | 8 | 2 | 8 | 2 | 8 |

| Sub-score 2 | 38 | 38 | 38 | ||||

| % | 90% | 90% | 90% | ||||

| 3.Tender process efficiency and project execution | |||||||

| Speed and quality of response | 2 | 1 | 2 | 1 | 2 | 2 | 4 |

| Understating of the requirement | 3 | 3 | 9 | 2 | 6 | 3 | 9 |

| Factory acceptance test (FAT) testing convenience and facilities | 3 | 3 | 9 | 2 | 6 | 3 | 9 |

| FAT testing with integrated with existing equipment | 2 | 0 | 0 | 2 | 4 | 0 | 0 |

| Training of operational and maintenance staff | 3 | 3 | 9 | 3 | 9 | 3 | 9 |

| Availability of resources during the design phase (in region) | 2 | 0 | 0 | 0 | 0 | 2 | 4 |

| Sub-score 3 | 29 | 27 | 35 | ||||

| % | 64% | 60% | 78% | ||||

| 4.After sales and product life cycle | |||||||

| Availability of remote support 24/7 and its cybersecurity protection | 4 | 2 | 8 | 3 | 12 | 3 | 12 |

| Availability of regional or in country support 24/7 | 3 | 0 | 0 | 1 | 3 | 2 | 6 |

| Size of the support organization | 3 | 3 | 9 | 2 | 6 | 2 | 6 |

| Production life cycle duration and software update/upgrade strategy | 3 | 3 | 9 | 2 | 6 | 3 | 9 |

| Availability of spare part | 3 | 2 | 6 | 2 | 6 | 2 | 6 |

| Provision of support in different languages. | 2 | 0 | 0 | 1 | 2 | 3 | 6 |

| Sub-score 4 | 32 | 35 | 45 | ||||

| % | 59% | 65% | 83% | ||||

| 5.Reputation and references | |||||||

| Certification to international standards: building SIL (Safety integrity level) rated systems | 3 | 3 | 9 | 3 | 9 | 3 | 9 |

| Certification to international standards: integrated management system | 2 | 3 | 6 | 3 | 6 | 2 | 4 |

| Proffered vendor with O&G majors or large tank storage companies | 2 | 1 | 2 | 2 | 4 | 3 | 6 |

| Sub-score 5 | 17 | 19 | 19 | ||||

| % | 81% | 90% | 90% | ||||

| 6.Additional services | |||||||

| Alarm management consultancy/support | 2 | 3 | 6 | 3 | 6 | 3 | 6 |

| Control room design consultancy | 1 | 2 | 2 | 3 | 3 | 0 | 0 |

| Provide services in addition to automation system | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sub-score 6 | 8 | 9 | 6 | ||||

| % | 67% | 75% | 50% | ||||

| TOTAL SCORE | 188 | 192 | 203 | ||||

| % | 78% | 80% | 85% | ||||

with major oil and gas company or with a sister company if the terminal storage facility is part of a group. List of criteria which fall under this group are:

- Certification to international standards: building SIL (Safety integrity level) rated systems;

- Certification to international standards: integrated management system;

- Proffered vendor with O&G majors or large tank storage companies.

Group 6: Additional services

This group covers some additional features and options that usually are not part of the scope of work, however this can be considered as a positive point in favour of the provider in case the offers received from different providers are similar. Availability of an additional option could be a competitive advantage. List of criteria which fall under this group are:

- Alarm management consultancy/support;

- Control room design consultancy;

Provide services in addition to automation system.

4.4. Assessment of the offers

After listing the defined criteria, the second phase of the workshop was to attribute a weight to each criterion, this process depends highly on the experience of the SME, and the impact on the business. This work can be done prior to the availability of the offers. Final step of the assessment is to assign a score for each supplier against each criterion. Table 3 shows the framework used and the results of the assessment of 3 offers for the implementation of a supervision system within a liquid petroleum storage facility.

4.5. Analysis of the assessment results

Based on the results of table 3, we can assume that Supplier 3’s offer should be retained as the best technical offer. However, going deep in our analysis, there is some significant insights to be highlighted. Firstly, we can observe that supplier 1 who has provided the most complete set of offering (97%) compared to Supplier 3 (91%), has the lowest global score. This is due basically to the low sub-score on the tendering process efficiency (64%) and the after sales services (59%). The reason behind this is the non-availability of regional representation of the supplier, this factor is highly important in terms of maintenance contract and also during the engineering/design phase. Being close to your customers is well appreciated by Managers who are in charge of plants working 24/7 such as a petroleum terminal. For business and safety consideration, petroleum storage facilities require high availability of the supervision system.

Regarding the tendering efficiency, Supplier 1 has recorded some delay in providing quick answers during the technical clarification process, this has impacted negatively its image and position. We also notice that Supplier 1 has the lowest sub-score on references (81%) compared to Supplier 2 (90%) and Supplier 3 (90%). This is due to the fact that Supplier 1 is not considered as a preferred vendor with O&G majors who are based worldwide and requiring from any strategic supplier to be present nearby its facilities.

Comparing the overall score for Suppliers 2 and 3 (80% and 85% respectively), we can consider that both suppliers are technically accepted. Suppliers 3 has a competitive advantage related to: support in different languages and a much stronger regional presence compared to Supplier 2.

In the light of this results, the technical choice of Supplier 3 could be made straight forward. On the other hand, Supplier 2 remains a good option, it is present in the region and it offers some additional services related to control room design consultancy. However, before making the final decision, there are other considerations to be taken into account such as the financial offer, the commercial terms and conditions as well as the duration of the project execution. All these factors are part of the decision-making process.

4.6. Gap analysis

On the following paragraph we have produced a Gap analysis (see table 4) to have a wider view and a better understanding of what is required from the supplier and what have been offered by them. Finally, we have suggested some actions to be taken by the supplier to meet the customer’s requirement.

Table 4: GAP analysis

| Supplier 1 | ||||

| Current | Ideal | Gap | Recommendations | |

| Services offered | The supplier provides a wide range of services covering most of activities carried currently on the terminal storage activity | The offered services should cover the existing services as well as future ones in case of any change on the business model | 3% | Supplier should enhance its offer to provide a more robust service related to external pipelines and drumming monitoring |

| Interfaces capabilities | The supervision system is developed to interface with most common L4/ERP systems and L1 equipment’s using common international standards. | The supervision system must interface with all L1 equipment’s and sensors without exceptions | 10% | It’s recommended that during the site survey, provider to collect all relevant data and make sure that all L1 devices will interface with the DCS/SCADA |

| Tender efficiency and project execution | Suppliers shows low reactivity during the clarification phase. Factory acceptance test is available as well a training material. There is no availably of the project team in the region | The customer’s need should be clearly understood. Availability of resources (in region) during the design phase. Factory acceptance testing should be integrated with the existing systems | 36% | Supplier to invest on a testing workbench where simulation of the facility conditions and parameters might be tested and verified. Also, it’s vital to have resources available (in region) during the design phase, at least temporarily. |

| After sales and product life cycle | Remote support is cyber-secured and available 24/7 without regional presence and only in English and French. Product lifecycle/updates strategy is well defined | The remote support should be available in region/in country, provided in different languages, available 24/7 and access to be cyber-secured. Software future upgrades and lifecycle strategy should be clearly defined | 41% | Supplier to develop regional presence to support customers for troubleshooting. Also, it’s important to introduce other languages to break the language barriers |

| Reputation and references | Supplier and DCS/SCADA systems are certified to international standards. The system has been installed in a limited number of facilities considered as O&G major | The supplier internal organization as well as the DCS/SCADA should be certified to international standard. The proposed system should have been implemented in other similar facilities | 11% | Supplier to review the commercial strategy in order to be part of the preferred vendors with O&G majors |

| Additional services | Supplier provides consultancy services related to alarm management support and control room design | Provide additional services such as alarm management support, control room design consultancy as per ISO 11064 and other services in addition to automation | 33% | Supplier to diversify its business model to introduce additional services |

| Supplier 2 | ||||

| Current | Ideal | Gap | Recommendations | |

| Services offered | The supplier provides a wide range of services covering most of activities carried currently on the terminal storage activity | The offered services should cover the existing services as well as future ones in case of any change on the business model | 3% | Supplier should enhance its offer to provide a more robust service related to external pipelines and drumming monitoring |

| Interfaces capabilities | The supervision system is developed to interface with most common L4/ERP systems and L1 equipment’s using common international standards. | The supervision system must interface with ALL L1 equipment’s and sensors without exceptions | 10% | It’s recommended that during the site survey, provider to collect all relevant data and make sure that all L1 devices will interface with the DCS/SCADA |

| Tender efficiency and project execution | Suppliers shows low reactivity during the clarification phase. factory acceptance test is available as well a training material. The workbench allows an integrated testing with most of the existing equipment. There is no availably of the project team in the region | The customer’s need should be clearly understood. Availability of resources (in region) during the design phase. Factory acceptance testing should be integrated with the existing systems | 40% | Supplier to review internal process to make sur that tenders are properly followed mainly in term of response time.

it’s vital to have resources available (in region) during the design phase, at least temporarily |

| After sales and product life cycle | Remote support is cyber-secured and available 24/7 without regional presence and only in English and French. Product lifecycle/updates strategy is defined | The remote support should be available in region/in country, provided in different languages, available 24/7 and access to be cyber-secured. Software future upgrades and lifecycle strategy should be clearly defined | 35% | Supplier to develop regional presence to support customers for troubleshooting. Also, it’s important to introduce other languages to break the language barriers |

| Reputation and references | Supplier and DCS/SCADA systems are certified to international standards. The system has been installed in some facilities considered as O&G major | The supplier internal organization as well as the DCS/SCADA should be certified to international standard. The proposed system should have been implemented in other similar facilities | 10% | Supplier to review the commercial strategy in order to be part of the preferred vendors with all O&G majors |

| Additional services | Supplier provides consultancy services related to alarm management support and control room design as per the required standard | Provide additional services such as alarm management support, control room design consultancy as per ISO 11064 and other services in addition to automation | 25% | Supplier to diversify its business model to introduce additional services |

| Supplier 3 | ||||

| Current | Ideal | Gap | Recommendations | |

| Services offered | The supplier provides a wide range of services covering most of activities carried currently on the terminal storage activity | The offered services should cover the existing services as well as future ones in case of any change on the business model | 3% | Supplier should enhance its offer to provide a more robust service related to external pipelines and drumming monitoring |

| Interfaces capabilities | The supervision system is developed to interface with most common L4/ERP systems and L1 equipment’s using common international standards. | The supervision system must interface with ALL L1 equipment’s and sensors without exceptions | 10% | It’s recommended that during the site survey, the supplier has to collect all relevant data and make sure that all L1 devices will interface with the DCS/SCADA |

| Tender efficiency and project execution | Supplier has clearly understood the customer’s requirement. There is a possibility to conduct a factory acceptance test (FAT) and the project team is available in the region | The customer’s need should be clearly understood. Availability of resources (in region) during the design phase. Factory acceptance testing should be integrated with the existing systems | 22% | Supplier to invest on a testing workbench where simulation of the facility conditions and parameters might be tested and verified. |

| After sales and product life cycle | Remote support in different languages is cyber-secured and available 24/7 with regional presence. however, the size of the support organization is relatively small. Product lifecycle/updates strategy is defined | The remote support should be available in region/in country, provided in different languages, available 24/7 and access to be cyber-secured. Software future upgrades and lifecycle strategy should be clearly defined | 17% | Supplier to invest on developing the local support organization

|

| Reputation and references additional services | Supplier and DCS/SCADA systems are certified to most of international standards. The system has been installed in many facilities considered as O&G major | The supplier internal organization as well as the DCS/SCADA should be certified to international standard. The proposed system should have been implemented in other similar facilities | 10% | Supplier to review its process in order to comply with all required international standards |

| Additional services | Supplier provides consultancy services related to alarm management only | Provide additional services such as alarm management support, control room design consultancy as per ISO 11064 and other services in addition to automation | 25% | Supplier to diversify its business model to introduce additional services |

5. Recommendations

The decision-making framework presented in this paper is a result of a work of a group of experts for a specific location. It is recommended that this tool is tested, reviewed and used by other terminals with different configurations and constraints in order to verify the consistency of the results and the relevance of the key criteria. It is also recommended to follow up the implementation of the supervision system project in order to confirm the adequacy of the retained supplier to do the required job and to meet the terminal expectations and needs. Moreover, during the project execution, there might be new challenges and new inputs not captured on the early stages of the project and have to be considered as a key criterion on the next iteration.

6. Conclusion

A liquid petroleum storage facility plays a strategic role in the value chain of the petroleum industry. The market is becoming very competitive and terminals are seeking ways to improve their efficiency and productivity in order to meet customers’ expectations. Storage facility operators need to streamline their business processes in order to stay competitive and profitable. To answer these challenges, terminal operators need to introduce some automation by investing in a supervision system instead of managing the facility manually. Many supervision solutions provide monitoring, control and management of the entire product handling process, starting from reception to storage to distribution. Due to the high cost of the introducing automation into a facility, it is vital to have a robust system in place to clearly identify the best offer to retain. There is a balance between the cost and the provided options that should be maintained, hence the importance of clearly defining what are the most important options to keep and the less important ones to reject. In this paper, we have introduced a tool that can be gradually introduced and tested in different terminals and similar projects. The methodology can also be adopted for a non-automation project. From the vendor perspective, this work represents a valuable feedback from a real case study where professionals from the oil&gas sector have highlighted what they expect from a supervision system, this might be an inspiration for them to build strong commercial and technical approach to address their current gaps.

Conflict of Interest

The authors declare no conflict of interest.

- L. J. Fernandes, S. Relvas, and A. P. Barbosa-Póvoa, “Strategic network design of downstream petroleum supply chains: Single versus multi-entity participation” Chem. Eng. Res. Des., 91(8), 1557–1587, 2013, https://doi: 10.1016/j.cherd.2013.05.028.

- M. Z. Ming, N.S. Shah, “Petroleum terminal’s operation processes on vessel turnaround,” EASTS-International Symposium on Sustainable Transportation incorporating Malaysian Universities Transport Research Forum Conference, Malaysia, 2008.

- International Energy Agency (IEA), “Oil information: Overview” France, 2020. [Online]. Available: www.iea.org.

- S. Traver, “Current Refining Capacity and Future Storage Requirements in Singapore” Asia Bulk Liq. Storage Transp. Termin. Conf. Singapore, 2007.

- J. van den Berge, “The hottest terminal locations of 2020,” Insights Global, 2020. https://www.insights-global.com/the-hottest-terminal-locations-of-2020/ (accessed Jul. 10, 2020).

- T. Plessas, D. Chroni, A. Papanikolaou, and N. Adamopoulos, “Simulation and optimisation of cargo handling operations of AFRAMAX tankers” Proc IMechE Part M J. Eng. Marit. Environ., 2015, https://doi: 10.1177/1475090215589643.

- P. Davidson, “The importance of Bulk Liquid Storage” Chemical Industry Journal., 2020.

- K. Al-Qahtani and A. Elkamel, “Multisite facility network integration design and coordination: An application to the refining industry” Comput. Chem. Eng., 32(10), 2189-2202, 2008, https://doi:10.1016/j.compchemeng.2007.10.017.

- A. Nooraii and J. A. Romagnoli, “Implementation of advanced operational and control techniques for a pilot distillation column within a des environment” Comput. Chem. Eng., 22 (4), 695–708, 1998, https://doi: 10.1016/s0098-1354(97)00228-7.

- M. Karacor and E. Ozdemir, “New technological developments and selection criteria of industrial SCADA applications” IFAC Proc. Vol., 36(7), 181–185, 2003, https://doi: 10.1016/S1474-6670(17)35828-7.

- American Petroleum Institute (API), “Welded Tanks for oil Storage. API Stand. 650” American Petroleum Institute, 2013.

- A. García-Berrocal, C. Montalvo, P. Carmona, and J. Blázquez, “The Coriolis mass flow meter as a volume meter for the custody transfer in liquid hydrocarbons logistics” ISA Trans., 90, 311–318, 2019, https://doi: 10.1016/j.isatra.2019.01.007.

- A. L. Henry Persson, “Tank Fires-Review of fire incidents 1951-2003” BRANDFORSK Project 513-021 report, Swedish National Testing and Research Institute, 2004.

- National Fire Protection Association (NFPA), “NFPA 24: Standard for the Installation of Private Fire Service Mains and their Appurtenances” National Fire Protection Association, 2012.

- A. A. Bakar, H. Hashim, and M. Z. Ahmad, “Implementation of SCADA System for DC Motor Control” 2010 Int. Conf. Comput. Commun. Eng. (ICCCE 2010), Malaysi, 2010, https://doi: 978-1-4244-6235-3/10/.

- A. Rezai, P. Keshavarzi, and Z. Moravej, “Key management issue in SCADA networks: A review” Eng. Sci. Technol. an Int. J., 20(1), 354–363, 2017, https:/doi: 10.1016/j.jestch.2016.08.011.

- K. Stouffer, J. Falco, and K. Scarfone, “Guide to Industrial Control Systems ( ICS ) Security Recommendations of the National Institute of Standards and Technology” NIST Spec. Publ., 800(82), 16–16, 2007, https://doi: http://dx.doi.org/10.6028/NIST.SP.800-82r1.

- I. Morsi and L. M. El-Din, “SCADA system for oil refinery control” Meas. J. Int. Meas. Confe., 47(1), 5–13, 2014, https::/doi: 10.1016/j.measurement.2013.08.032.

- Frost & Sullivan, “Analysis of the Distributed Control Systems (DCS) Market in India,” Frost & Sullivan, 2013.

- A. Dike, I. U., Adoghe, A. U., Abdulkareem, “Impact of ICT in Oil and Gas Exploration: A Case Study” Int. J. Comput. Technol., 10(7), 1831–1835, 2013.

- R. S. Bhullar, “Strategies for implementing advanced process controls in a distributed control system (DCS)” ISA Trans., 32(2), 147–156, 1993, https://doi: 10.1016/0019-0578(93)90037-W.

- Y. N. Shebeko et al., “Fire and explosion risk assessment for large-scale oil export terminal” J. Loss Prev. Process Ind., 20(4–6), 651–658, 2007, https://doi: 10.1016/j.jlp.2007.04.008.

- R. K. Sharma, B. R. Gurjar, A. V. Singhal, S. R. Wate, S. P. Ghuge, and R. Agrawal, “Automation of emergency response for petroleum oil storage terminals” Saf. Sci., 72, 262–273, 2015, https://doi: 10.1016/j.ssci.2014.09.019.

- J. I. Chang and C. C. Lin, “A study of storage tank accidents” J. Loss Prev. Process Ind., 19(1), 51–59, 2006, https://doi: 10.1016/j.jlp.2005.05.015.

Citations by Dimensions

Citations by PlumX

Google Scholar

Scopus

Crossref Citations

- Ossama Rashad, Omneya Attallah, Iman Morsi, "A PLC-SCADA Pipeline for Managing Oil Refineries." In 2022 5th International Conference on Computing and Informatics (ICCI), pp. 216, 2022.

- Mykhaylo Lobur, Mykola Malyar, "Selecting a Monitoring Technology for a Control System of Distributed Oil Production Facilities." Energy engineering and control systems, vol. 10, no. 1, pp. 28, 2024.

- Khalid Chkara, Mohammed Rida Ech-charrat, "Digital Monitoring Systems Based on Artificial Intelligence for the Oil Industry." In International Conference on Advanced Intelligent Systems for Sustainable Developent (AI2SD 2024), Publisher, Location, 2025.

- Khalid Chkara, Mohammed Rida Ech-charrat, "Toward a Smart Supervision in the Oil & Gas Industry Using IA." In International Conference on Advanced Intelligent Systems for Sustainable Developent (AI2SD 2024), Publisher, Location, 2025.

- Ossama Rashad, Omneya Attallah, Iman Morsi, "A smart PLC-SCADA framework for monitoring petroleum products terminals in industry 4.0 via machine learning." Measurement and Control, vol. 55, no. 7-8, pp. 830, 2022.

No. of Downloads Per Month

No. of Downloads Per Country