Multi-attribute Reverse Auction Design Based on Fuzzy Data Envelopment Analysis Approach

Multi-attribute Reverse Auction Design Based on Fuzzy Data Envelopment Analysis Approach

Volume 2, Issue 3, Page No 1323-1329, 2017

Author’s Name: Deyan Chena), Dingwei Wang

View Affiliations

Institute of Systems Engineering, College of Information Science and Engineering, Northeastern University, 110000, Shenyang, China

a)Author to whom correspondence should be addressed. E-mail: chendy0413@163.com

Adv. Sci. Technol. Eng. Syst. J. 2(3), 1323-1329 (2017); ![]() DOI: 10.25046/aj0203167

DOI: 10.25046/aj0203167

Keywords: Multi-attribute reverse auction, Multiple winner, Fuzzy data envelopment analysis, Winner determination, Bidding strategy

Export Citations

Multi-attribute reverse auction is widely used for the procurements of enterprises or governments. To overcome the difficulty of identifying bidding attribute weight and score function of the buyer, the multi-round auction and bidding models with multiple winners are established based on fuzzy data envelopment analysis. The winner determination model of the buyer considers the integrated input-output efficiency of k winners. The bidding strategy of seller is divided into two parts: the first one estimates the weight of the ideal supplier that is thought to be the buyer’s preference; the second one is to calculate the weight of the test supplier which reflects the change trend of current weights and the seller’s weakness. The final predicted weight is the weighted sum of both. On the basis of known weight, the test supplier can improve his efficiency to increase the winning chance in the next round auction. Our models comprise crisp numbers and fuzzy numbers. Finally, a numerical example verifies the validity of the proposed models.

Received: 30 April 2017, Accepted: 29 June 2017, Published Online: 01 August 2017

1. Introduction

This paper is an extension of work originally presented in 2016 31st Youth Academic Annual Conference of Chinese Association of Automation [1].

With the rapid development of network technology and electronic commerce, multi attribute reverse auction has been widely applied to the enterprise or government procurement of goods or services due to saving cost, increasing income and conducting comprehensive assessment of multiple indexes. Especially, online procurement auction plays an important role in E-commerce [2].

In all these studies, the score function of supplier evaluation and the weight of bidding attribute need to be predefined ahead of time. But in the real auction process, it is hard to achieve because of complex environment. Furthermore, accurate description of uncertain or vague attributes is another critical issue in practice, especially in a multi-round multi-attribute reverse auction.In the multi-attribute reverse auction, winner determination problem of the auctioneer and bidding strategies of bidders are two key problems. Many scholars have done a lot of work. At present, there are two main research methods: one is from the perspective of game theory. An optimal auction model was designed with two attributes of price and quality and the best bidding strategy for a bidder was provided where a linear score function was used to evaluate the bids in [3]. This model was extended to an extensive application from different aspects in [4, 5]. A decision support model was used to solve the winner determination problem of the multi-attribute reverse auction in [6]. Another is from the perspective of decision theory. The multi-attribute auction problem based on the technique of order preference was studied in [7]. A fuzzy multi-attribute matching and negotiation mechanism of single round reverse auction with fuzzy numbers was studied in [8]. A PT–BOCR decision method of risk-averse bidders was developed where prospect theory was incorporated into the “benefits, opportunities, costs and risks” framework in [9]. Mathematical programming model was applied for the selection of suppliers in [10]. In [11], the winner determination problem was solved through an evolutionary algorithm of goal programming model.

Since data envelopment analysis (DEA) was firstly proposed by Charnes in [12], it has been broadly used in various fields. DEA is a nonparametric linear programming method for evaluating the input-output efficiency of decision making unit (DMU) [13]. Thus, to avoid the difficult of the determination of score function and weight of bidding attribute, DEA is proved to be an advantageous tool in multi-attribute reverse auction. Bogetoft and Nielsen developed a DEA based auction mechanism with asymmetric information and correlated costs [14]. DEA was combined with an integer programming model to elicit preference information of the buyer in [15]. Data envelopment analysis was applied to the selection problem of multi-attribute reverse auction from the perspective of the suppliers in [16]. But all these DEA models are solved under the assumption of the crisp input–output data [17]. However, the input–output data in most auction models are often vague or imprecise in a real world when the auction relates to multiple different attributes. Thus fuzzy DEA provide a powerful tool to solve the vague or imprecise information. Meanwhile, a great of works has already been done in many fields [18–21].

In this paper, by the fuzzy DEA and possibility theory, we develop a winner determination decision model with multiple winners, in which sealed-bid multi-attribute reverse auction can be conducted regularly, that means a multi-attribute multi-round simultaneous auction. From the perspective of unselected supplier, we consider weight information of ideal supplier and winning supplier simultaneously, and predict the possible weight in the next round auction. Under the premise of increasing input-output efficiency, the test supplier will stand a chance to win bids in the next round auction by improving the value of bidding attribute. The developed methods comprise two new characteristics. To begin, Fuzzy numbers are allowed for existence in the multi-attribute reverse auction model. The score function of buyer is not essential to auctioneer and bidders. Moreover, strategies of buyer and sellers are given based on the same principle. The decision of bidding attribute weight is no longer a complicate problem. All the models can be transformed into linear programming problems and it is easy to compute for the practical application.

The rest of this paper is organized as follows: The multi-attribute multi-round reverse auction design is depicted in section 2. In section 3, the winner determination model for the buyer with multiple winners is suggested in view of fuzzy DEA. The bidding model of unselected seller is also presented for the same scene. A numerical example is given to demonstrate the proposed models in section 4. In section 5, the conclusions are presented.

2. Auction Mechanism Design

In this section, the proposed multi-attribute reverse auction mechanism is described and the related application background and conditions are presented.

There exists a buyer and multiple suppliers in the proposed multi-round sealed-bid reverse auction. The single buyer needs to procure the same k indivisible commodities provided by the different k suppliers at regular intervals. All the suppliers want to make a bid to become the winners in each procurement auction. It is similar to a multi-unit multi-round multi-attribute simultaneous auction. When k=1, it is a multi-attribute single–item reverse auction for an indivisible commodity.

In every auction cycle, the buyer first sends the request for quotes which provides the basic demand and requirement for the bidders. For example, the buyer has a minimum or maximum threshold value for bidding attributes. At the same time, the last round winners’ quotes information is shared by all the bidders. All the bidders know that the buyer evaluates suppliers mainly through the input-output performance. However, they don’t know the true attribute weight. Second, the qualified suppliers, who fulfill the demand and requirement of buyer, submit bids on multiple attributes of procured commodities. And some of attribute value are fuzzy numbers which describe the vague and imprecise information of procured commodity. Here the previous winners’ bidding information is a common reference for all the suppliers. Each supplier only has one chance to bid and the submission cannot be revised. Finally, the buyer decides the final k winners according to their integrated input-output efficiencies and declares the corresponding information of the k winning suppliers.

This auction mechanism is common among enterprise and government procurement. Therefore, the decision of strategies of buyer and sellers are significant. In the next section, winner decision making model of buyer and the bidding model of sellers are established respectively.

3. Winner Decision Models of the Buyer

In this section, basic knowledge of fuzzy number and fuzzy DEA is introduced. Then the winner determination model of buyer with multiple winners is proposed based on fuzzy DEA model. At last, the bidding model of sellers is constructed, where the preference weight of buyer and possible weight reflecting the weakness of the seller are reckoned simultaneously.

3.1. Fuzzy Arithmetic and Fuzzy DEA

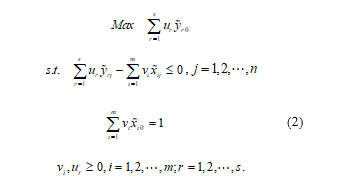

A fuzzy number is a fuzzy set characterized by a given real number interval, whose value of membership is between 0 and 1. It is often used to describe a vague, imprecise variable or a linguistic variable in a more direct form. The triangular fuzzy number is most commonly used in practice. It is defined by the following membership function .

where are non-negative and holds. A crisp real number is regarded as a special case of triangular fuzzy number. We usually denote the triangular fuzzy number as .

where are non-negative and holds. A crisp real number is regarded as a special case of triangular fuzzy number. We usually denote the triangular fuzzy number as .

We denote two triangular fuzzy numbers as and respectively. Then the fuzzy arithmetic operations on and are defined as follows [19]:

Addition: ;

Subtraction: ;

Multiplication: ;

Division:

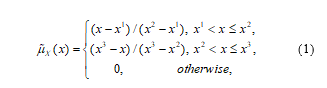

Fuzzy DEA model has the following primal linear programming statement for the CCR model [18].

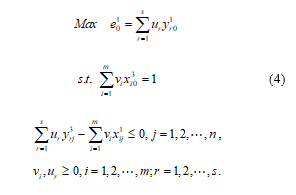

where the subscript 0 is the decision making unit(DMU) under the evaluation. When input and output data of (2) are be characterized by positive triangular fuzzy numbers and including crisp input and output data as a special case of triangular numbers, we can obtain the following fuzzy DEA model.

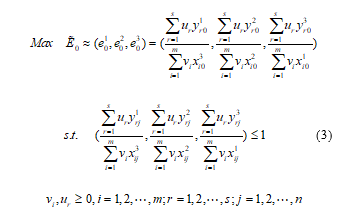

where represents the fuzzy efficiency of DMU0 under evaluation and it is also a triangular fuzzy number. In accordance with the existing method, (3) can be transformed into the following three linear programming models [19].

where represents the fuzzy efficiency of DMU0 under evaluation and it is also a triangular fuzzy number. In accordance with the existing method, (3) can be transformed into the following three linear programming models [19].

The fuzzy efficiency of each DMU is derived from the above models. All the DMUs are ranked according to efficiencies of the above objective value.

The fuzzy efficiency of each DMU is derived from the above models. All the DMUs are ranked according to efficiencies of the above objective value.

A variety of methods are proposed to compare fuzzy number, we use the preference degree approach to rank the fuzzy numbers [19]. Let and be two triangular fuzzy numbers, then the degree of preference of is defined as follows.

where represents the area of in the imagine of membership function of and represents the area of in the imagine of membership function of . From the definition of the degree of preference , we know that . In general, if , we think that is bigger than and if , we think that is smaller than . When , is indifferent to .

Based on the degree of preference, we can compare any two fuzzy numbers, and then a complete priority order of fuzzy efficiencies of suppliers can be obtained in the following multi-attribute reverse auction.

3.2. Auction Models of the buyer with Multiple Winners

In the multi-attribute reverse auction, multiple attributes of procured commodity may be vague or imprecise which cannot be impressed by the crisp real numbers. For example, the design level of a commodity, the reputation of a seller and so forth. It is necessary to consider the evaluation problem of suppliers with fuzzy attribute data. Thus, on the base of the fuzzy DEA theory, we construct a winner determination model of multi-attribute reverse auction with multiple winners from the perspective of buyer.

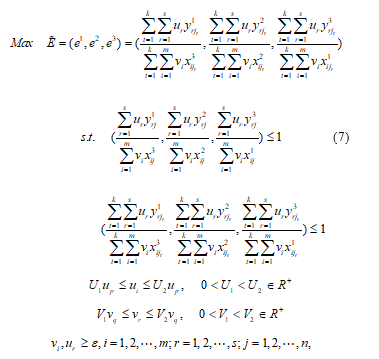

As we need to determine k winners once in an auction, total input-output efficiency of selected k suppliers is taken for the objective function. After adding some appropriate constraints, (3) can be transformed into the following three linear programming models to determine the final k winners of multi-attribute reverse auction.

where is the optimal fuzzy efficiency of the combination of k suppliers, compared with the previous fuzzy DEA model. Here the input and output are the total sum of k suppliers respectively. are the proportional coefficients of preference of the buyer corresponding to the inputs and outputs. They indicate the relative preference of the buyer for the different attributes, and , which ensures nonzero solution of weight in (7).

where is the optimal fuzzy efficiency of the combination of k suppliers, compared with the previous fuzzy DEA model. Here the input and output are the total sum of k suppliers respectively. are the proportional coefficients of preference of the buyer corresponding to the inputs and outputs. They indicate the relative preference of the buyer for the different attributes, and , which ensures nonzero solution of weight in (7).

Similarly, (7) can also be transformed into the following three linear programming models.

Calculate the above three linear programming models, the optimal fuzzy efficiency of multiple winners can be obtained and the corresponding k winners are determined.

Calculate the above three linear programming models, the optimal fuzzy efficiency of multiple winners can be obtained and the corresponding k winners are determined.

3.3. Bidding Models of Sellers

In the proposed multi-attribute procurement auction, the attribute value of winning suppliers is the common knowledge in each period. A seller knows that the input-output efficiency of suppliers is the principal index that the buyer evaluates a supplier. In this specific context, the only available information is the bidding attribute values of k winners and the seller’s own quote. The seller thinks the accurate weight value of bidding attributes of procured commodity is affected by the following two aspects: one is the preference of the buyer which can be characterized by the weight of the ideal supplier; the other is the current impact which can be described by the weight of the unselected supplier reflecting his weakness. The predicted weight in the next round auction can be seen as a weighted sum of above two parts after being introduced a weighting factor. In view of the above two points, (11) and (12) are established to compute the preference weight of buyer and the current possible weights respectively.

where supplier * is the ideal supplier, that is the best supplier among all the bidders. It is obtained in the ways listed below. First, let , then we get the m input data of the ideal supplier; Second, suppose , the s output data are also decided. When the bidding attribute values are triangular fuzzy numbers, the degree of preference is used to compare them. The ideal supplier * is an optimal result for the selected suppliers which includes minimum input variables and maximum output variables. Supplier d is the test supplier who is not selected in the auction. Furthermore, are the proportional coefficients of preference of the buyer that are predicted by the supplier d, in view of calculation results of previous weights and his own experience. The first constrain means the integrated efficiency of k winning suppliers is less and equal to1. The second and third constrains make the efficiencies of the ideal supplier and test supplier fall in the interval [0, 1].

where supplier * is the ideal supplier, that is the best supplier among all the bidders. It is obtained in the ways listed below. First, let , then we get the m input data of the ideal supplier; Second, suppose , the s output data are also decided. When the bidding attribute values are triangular fuzzy numbers, the degree of preference is used to compare them. The ideal supplier * is an optimal result for the selected suppliers which includes minimum input variables and maximum output variables. Supplier d is the test supplier who is not selected in the auction. Furthermore, are the proportional coefficients of preference of the buyer that are predicted by the supplier d, in view of calculation results of previous weights and his own experience. The first constrain means the integrated efficiency of k winning suppliers is less and equal to1. The second and third constrains make the efficiencies of the ideal supplier and test supplier fall in the interval [0, 1].

where is given by the test supplier. The first two inequalities ensure the efficiency of k winners falls in the interval [ , 1], where it is considered to be optimal objective value that makes k suppliers become the final winners. In (11), the final weight solution vector is written as . Solve the linear programming model (12), we can obtain another weight vector which reflects the current change trend of weight and the weakness of the test supplier d.

where is given by the test supplier. The first two inequalities ensure the efficiency of k winners falls in the interval [ , 1], where it is considered to be optimal objective value that makes k suppliers become the final winners. In (11), the final weight solution vector is written as . Solve the linear programming model (12), we can obtain another weight vector which reflects the current change trend of weight and the weakness of the test supplier d.

In the auction process, inexact information and random factors are allowed. When including fuzzy data, (11) and (12) can be transforms into three linear programming models to compute the final fuzzy efficiency, three weight vectors will be obtained corresponding to the or respectively. Here we take corresponding to , and corresponding to since the middle bound value of a fuzzy number means the maximum possibility. Given a weighting factor , the predicted weight is written as follows

![]() where a seller can select a appropriate weighting factor to describe the change trend of attribute weight in the next round auction.

where a seller can select a appropriate weighting factor to describe the change trend of attribute weight in the next round auction.

Once the next period weight of bidding attributes is given, we can calculate the efficiencies of the k winning suppliers in the next auction when they do not change their bidding strategies. Because the efficiency of the supplier is a triangular fuzzy number, our goal is to make the lower bound of fuzzy efficiency of the test supplier is greater than or equal to the middle bound of fuzzy efficiency of one or more winning suppliers through adjusting bidding attribute values properly. Then the test supplier will have the opportunity to become the winner in the next round auction.

4. Numerical Example

In this section, an application of the established models is be demonstrated by the following datasets of bidding attribute value of suppliers. An enterprise need to purchase two new machines for production from two different suppliers regularly. There is a trade-off among price, delivery performance, quality and design in the multiple period auctions. The price of procured machine is expressed in thousand dollars and quality is expressed in percentage of qualified products manufactured by this type of machine. Delivery performance is expressed by days of service and it is a triangular fuzzy number. Design is a linguistic variable and it is expressed by a symmetric triangular fuzzy number. Specific bidding attribute data of five suppliers in the third round auction are shown in Table 1.

Table 1 Bidding attribute value of the suppliers

|

Supplier (DMUs) |

Inputs | Outputs | ||

|

Price ($) |

Delivery

|

Quality (%) |

Design

|

|

| 1 | 48 | (32,36,40) | 96 | (90,95,100) |

| 2 | 46.5 | (36,38,41) | 99 | (85,90,95) |

| 3 | 47.5 | (34,37,41) | 97 | (80,85,90) |

| 4 | 46 | (34,36,38) | 97 | (85,90,95) |

| 5 | 47 | (35,38,41) | 98 | (90,95,100) |

First, the buyer need determine the winners using (8), (9) and (10). Conforming to specification of models, we assumed that the weight of quality is somewhere between two and three times than the weight of design. This constrain condition reflects the inexact preference of the buyer for quality and design. It is easier to describe this kind of imprecise information than to give an exact result in practice. At the same time, the buyer thinks .

Because only two suppliers of five will become the final winners, efficiencies of 10 groups of suppliers need to be compared, and it is shown in Table 2. We use previously introduced degree of preference to rank them, supplier 2 and supplier 5 will be the final winners.

Table 2 Fuzzy efficiencies of suppliers with two winners

| Suppliers | Efficiency | Suppliers | Efficiency |

| {1,2} | (0.9465,0.9657,0.9938) | {2,4} | (0.9649,0.9825,0.9978) |

| {1,3} | (0.9238,0.9440,0.9835) | {2,5} | (0.9615,0.9809, 1) |

| {1,4} | (0.9465,0.9639, 1) | {3,4} | (0.9414,0.9725,0.9835) |

| {1,5} | (0.9434,0.9644, 1) | {3,5} | (0.9384,0.9585,0.9818) |

| {2,3} | (0.9415,0.9607,0.9793) | {4,5} | (0.9616,0.9802, 1) |

Then we use (11) and (12) to analysis the data of the test supplier and the winning suppliers for three auction cycles in Table 3 and Table 4. From the perspective of an unselected supplier, we need to determine his bidding strategy in the next phase.

Table 3 Bidding attribute value of the winning supplier 1

|

Period |

Attributes of winner 1 | |||

| Price | Delivery | Quality | Design | |

| 1 | 46 | (34,36,37) | 98 | (85,90,95) |

| 2 | 47 | (33,35,38) | 97 | (75,80,85) |

| 3 | 46.5 | (36,38,41) | 99 | (85,90,95) |

Table 4 Bidding attribute value of the winning supplier 2

|

Period |

Attributes of winner 2 | |||

| Price | Delivery | Quality | Design | |

| 1 | 47 | (36,39,41) | 98 | (85,90,95) |

| 2 | 46.5 | (36,38,41) | 99 | (85,90,95) |

| 3 | 47 | (35,38,42) | 98 | (90,95,100) |

Supplier 4 isn’t selected in the third round auction, thus supplier 4 is taken as the test supplier. In Table 1, we know that his bidding attribute value is 46, (34, 36, 38), 97 and (85, 90, 95) in the third round auction. The ideal supplier’s bidding attribute value is 46, (34, 36, 37), 99 and (90, 95, 100) respectively (as shown in Table 3). The comparisons of fuzzy numbers are based on the degree of preference when calculating the bidding attribute value of the ideal supplier. Furthermore, in view of supplier 4’s experience, the weight of quality is somewhere between two and four times than the weight of design.

Computing the linear programming models (11) and (12), we obtain the efficiency of the ideal supplier is and the efficiency of test supplier is which also indicate how ineffective the test supplier 4 is. We take the solution vectors of the middle value of above two triangular fuzzy numbers as the preference weight of the buyer and the current possible weight. They are weight vectors and . Let we obtain the predicted weight is . It is noted that is decided by the test supplier which reflects his understanding to the future change trend of weights. The derived weight is regarded as attribute weight for the next round auction. Because the winning suppliers don’t change the bidding strategies, upon the new attribute weight, the middle bound value of supplier 2’s efficiency is 0.9586 and the middle bound value of supplier 5’s efficiency is 0.9535. At present, supplier 4 need improve his bidding attribute value to make the lower bound value of his efficiency is greater or equal to 0.9535 at least. For example, suppose quality and design is hard to revise, we might cut down the bidding value of input attributes. Let price is 45 and the others are unchanged, the lower bound value of efficiency of supplier 4 raises to 0.9590 that is greater than the middle bound value of supplier 5’s efficiency. Moreover, let delivery performance is (34, 36, 36), and the lower bound value of supplier 4’s efficiency is 0.9561 which also meets the requirement. Here the test supplier has great flexibility to change bid attribute value to be competitive in the fourth round auction.

5. Conclusions

Multi-attribute reverse auction is widely used in the procurement of enterprise and government. In this paper, a winner determination model of the buyer and a bidding model of the sellers are proposed with multiple winners in the multi-attribute multi-round reverse simultaneous auction. The bidding attribute value can be a real number or a triangular fuzzy number which describes the vague or inaccurate information. Basing on the fuzzy DEA theory, we construct a winner determination model with multiple winners for the buyer to compare the overall efficiency of k winners. The k suppliers with the highest efficiency are the final winners. From the unselected seller’s view, the weight of each attribute in the next round of auction is a crucial problem. We first compute the weight of the ideal supplier reflecting the buyer’s preference. Second, the weight of the test supplier is calculated to indicate the current change trend and the weakness of the failed supplier. In the end, a weighted value of above two parts is regarded as the next round weight. As the k winning suppliers do not change the original bidding strategies, a test supplier might compute their efficiencies and adjust his own bidding attribute value to make his efficiency greater than the known winners so as to have an opportunity to become the final winner in the next round auction. Overall, the proposed models can handle the vague and imprecise data in view of the actual circumstance of the auction and synthesis the previous information. At last, a numerical illustration verifies the feasibility of the proposed method.

Conflict of Interest

The authors declare no conflict of interest.

Acknowledgment

This study was supported by the National Natural Science Foundation of China under Grant No. 70931001 and 61273203.

- D. Chen, D. Wang, “Solving a multi-attribute reverse auction problem by fuzzy data envelopment analysis method” in 2016 31st Youth Academic Annual Conference of Chinese Association of Automation (YAC), China, 2016. http:// doi.org/10.1109/YAC.2016.7804866

- L. Pham, J. Teich, H. Wallenius, J. Wallenius, “Multi-attribute online reverse auctions: Recent research trends” Eur. J. Oper. Res., 242, 1–9, 2015. http://dx.doi.org/10.1016/j.ejor.2014.08.043

- Y. K. Che, “Design competition through multidimensional auctions” Rand J. Econ., 24, 668–680, 1993. http:// doi.org/102307/2555752.Source:RePEc

- F. Branco, “The design of multidimensional auctions” Rand J. Econ., 28, 63–81, 1997. http:// doi.org/102307/2555940.Source:RePEc

- E. David, R. A. Schwartz, and S. Kraus, “Bidding in sealed-bid and English multi-attribute auctions” Decis. Support Syst., 42, 527–556, 2006. http:// doi.org/10.1016/j.dss.2005.02.007

- M. Marzouk, O. Moselhi, “A decision support tool for construction bidding” Constr. Innov., 3, 111–124, 2003. http:// doi.org/10.1108/ 14714170310814882

- C. B. Cheng, “Slove a sealed-bid reverse auction problem by multiple-criterion decision-making methods” Comput. Math. Appl., 56, 3261–3274, 2008. http:// doi.org/10.1016/j.camwa.2008.09.011.Source:DBLP

- K. Tsai and F. Chou, “Developing a fuzzy multi-attribute matching and negotiation mechanism for sealed-bid online reverse auctions” J. Theor. Appl. Electron. Commer. Res., 6, 685–963, 2011. http:// doi.org/ 10.4067/s0718-18762011000300007.Source:DBLP

- M. Huang, X. H. Qian, S. C. Fang and X. W. Wang, “Winner determination for risk aversion buyers in multi-attribute reverse auction” Omega, 59, 184–200, 2016. http:// doi.org/10.1016/j.omega.2015.06.007

- J. E. Teich, H. Wallenius, J. Wallenius, and A. Zaitsev, “A multi-attribute e-auction mechanism for procurement: theoretical foundations” Eur. J. Oper. Res., 175, 90–100, 2006. http:// doi.org/10.1016/j.ejor.2005.04.023

- F. T. S. Chan, M. Shukla, M. K. Tiwari, R. Shankar, K. L. Choy, “B2B multi-attribute e-procurement: A artificial immune system based goal programming approach” Int. J. of Prod. Res., 49( 2), 321–341, 2011. http:// doi.org/10.1080/00207540902922802

- A. Charnes, W. W. Cooper, E. Rhodes, “Measure the efficiency of decision making unit” Eur. J. Oper. Res., 2(6), 429–444, 1978. http:// doi.org/10.1016/0377-2217(78)90138-8

- M. Azadi, M. Jafarian, R. F. Saen, S. M. Mirhedayation, “A new fuzzy DEA model for evaluation of efficiency and effectiveness of suppliers in sustainable supply chain management context” Comp. Oper. Res., 54, 274–285, 2015. http:// doi.org/10.1016/j.cor.2014.03.002

- P. Bogetoft and K. Nielsen, “DEA based auctions,” Eur. J. Oper. Res., 184, 685–700, 2008. http:// doi.org/10.1016/j.ejor.2006.11.010.Source:RePEc

- S. Talluri, R. Narasimhan, S. Viswanathan, “Information technologies for procurement decisions: A decision support system for multi-attribute e-reverse auctions” Int. J. of Prod. Res, 45(11), 2615–2628, 2007. http:// doi.org/10.1080/00207540601020585

- R. Narasimhan, S. Talluri, and S. Mahapatra, “Effective response to RFQs and supplier development: A supplier’s perspective,” Int. J. Prod. Econ., 115, 461–470, 2008. https://doi.org/:10.1016/j.ijpe.2008.07.001

- K. D. Kaveh, T. Madjid, H. S. Elham, “A data envelopment analysis model with interval data and undesirable output for combined cycle power plant performance assessment” Expert Syst. Appl., 42, 760—777, 2015. http:// doi.org/10.1016/j.eswa.2014.08.028

- S. Saati, A.Memariani, G. R. Jahanshahloo, “Efficiency analysis and ranking of DMUs with fuzzy data” Fuzzy Optim. Decis. Ma., 1, 255–267, 2002. http:// doi.org/10.1023/A:1019648512614

- Y. Wang, Y. Luo, L. Liang, “Fuzzy data envelopment analysis based upon fuzzy arithmetic with an application to performance assessment of manufacturing enterprises” Expert Syst. Appl., 36, 5205–5211, 2009. https://doi.org/:10.1016/j.eswa.2008.06.102

- F. Cebi, I. Otay, “A two-stage fuzzy approach for supplier evaluation and order allocation problem with quantity discounts and lead time” Inform. Sciences, 339, 143–157, 2016. http:// doi.org/10.1016/j.ins.2015.12.032

- K. D. Kaveh, T. Madjid, J. S. Francisco, “A comprehensive fuzzy DEA model for emerging market assessment and selection decision” Appl. Soft Comput., 38, 676–702, 2016. http:// doi.org/10.1016/j.asoc.2015.09.048